|

|

|

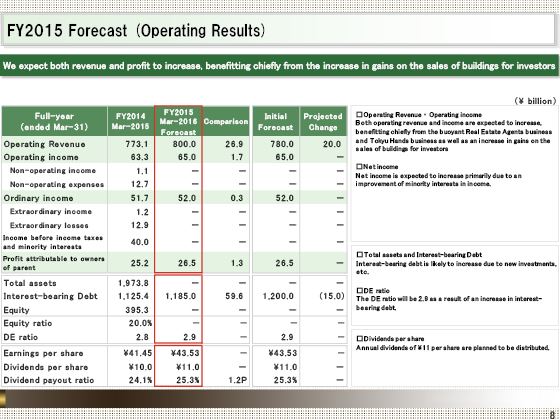

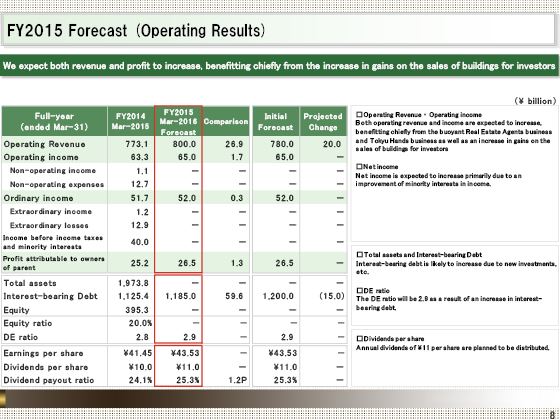

I will now provide you with a briefing on our full-year forecast for the fiscal year ending March 2016.

We expect operating revenue to be ¥800 billion, operating income to be ¥65 billion, ordinary income to be ¥52 billion, and net income to be ¥26.5 billion for the fiscal year ending March 2016.

We expect higher revenue and income based on the strong performance of the real-estate agent and Tokyu Hands businesses, and an increase in the sale of buildings for investors, etc.

Compared with the initial forecast, we have revised the operating revenue upward by ¥20 billion, mainly reflecting the review of sales plans for buildings for investors, etc.

We anticipate that interest-bearing debt will be ¥1,185 billion and the D/E ratio will be 2.9.

With respect to dividends, we plan to pay annual dividends of ¥11 per share as initially planned.

|

|

|