|

|

|

|

|

|

|

|

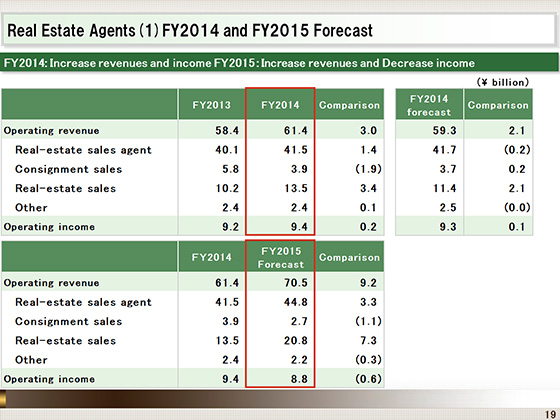

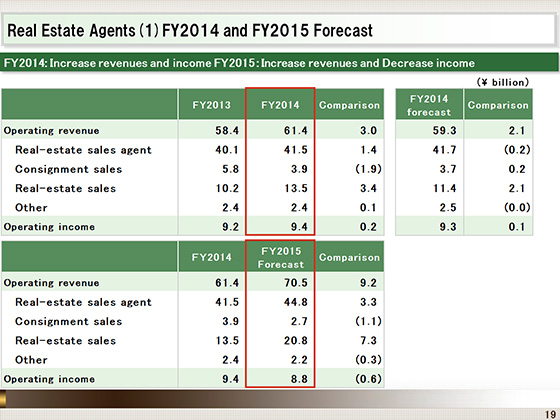

Now we will shift our attention to the Real Estate Agents segment.

For the fiscal year ended March 31, 2015, this segment attained a year-on-year operating revenue growth of ¥3.0 billion, rising to ¥61.4 billion, and a year-on-year increase of ¥0.2 billion in operating income, rising to ¥9.4 billion.

The sales agency operations achieved an increase in the number of transactions and contracted prices in retail sales, despite a decline in consignment sales following a decrease in the number of condominiums handed over. �Wholesale operations experienced a growth in contracts on large properties, despite the reduction in the number of contracts. This led to a rise in contracted prices. As a result, the segment achieved an increase in both revenue and income.

For the fiscal year ending March 31, 2016, the segment is projected to reach operating revenue of ¥70.5 billion, up ¥9.2 billion year on year, and an operating income of ¥8.8 billion, down ¥0.6 billion year on year.

Revenue growth is anticipated in light of buoyant sales agency operations, but income is expected to drop because of a decline in the revenue of consigned sales chiefly following the integration of development and sales.

|

|

|