|

|

|

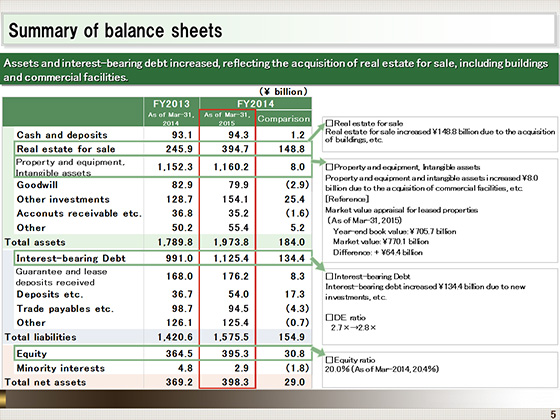

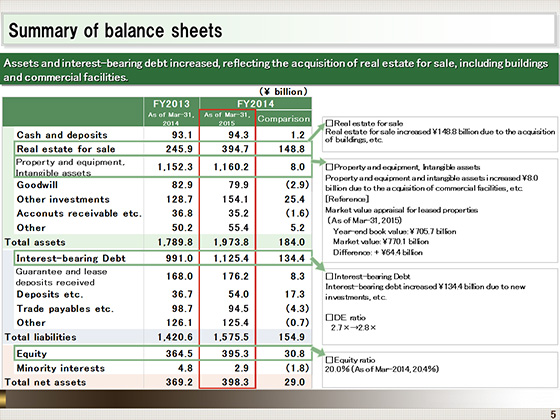

Moving on, here we have an outline of the balance sheet.

At the end of March 2015, total assets increased ¥184 billion to ¥1,973.8 billion.

In accordance with the investment policy under the medium- and long-term management plan, we positively acquired non-residential buildings, commercial facilities, and other real estate for sale.

As initially planned, interest-bearing debt swelled by ¥134.4 billion from the end of the preceding fiscal year to ¥1,125.4 billion. This was mainly due to the acquisition of real estate for sale.

Equity stood at ¥395.3 billion, with a year-on-year growth of ¥30.8 billion. The DE ratio stood at 2.8, and the equity ratio at 20.0%.

|

|

|