|

|

|

|

|

|

|

|

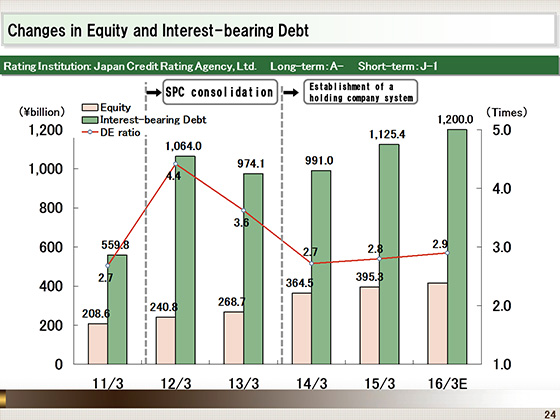

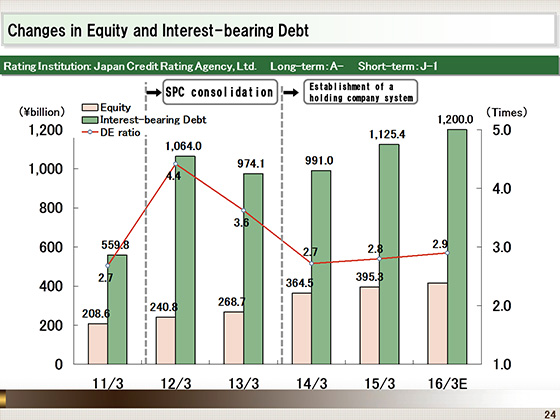

Next, we will turn our attention to the trends in equity and interest-bearing debt.

At the beginning of fiscal year ended March 31, 2012, we included a special purpose company within consolidated accounting. As a result, interest-bearing debt increased and DE rate rose to 4.4.

However, in the three year period under the former medium-term management plan, we sold some assets to REIT, accumulated periodic income, and made the change to a holding company structure. As a result of these efforts and other actions, our interest-bearing debt was reduced while equity expanded. The DE ratio at the end of March 2014 fell to as low as 2.7.

For the fiscal year ended March 31, 2015 and the fiscal year ending March 31, 2016, the reshuffling of the portfolio and the reinvestment of returns will be accelerated in accordance with the policy in the medium- and long-term management plan. Thus, interest-bearing debt will be on an upward trend, but we will work to ensure a balance with investment recovery in order to attain a DE ratio of 2.6 in the fiscal year ending March 31, 2017.

|

|

|