|

|

|

|

|

|

|

|

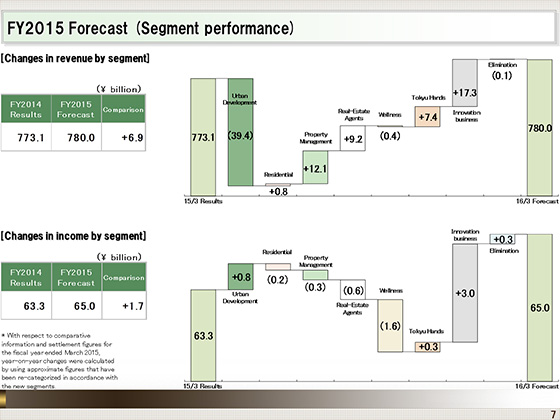

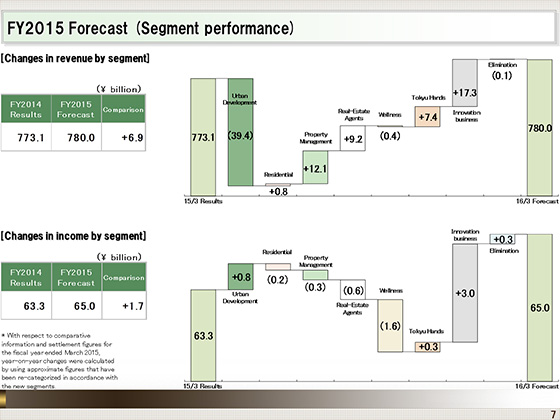

Next I will discuss the changes in the segment-specific operating revenue and operating income.

The changes from the financial results for the preceding year, namely for the fiscal year ended March 31, 2015, have been calculated with the use of estimated figures that reflect the changes in segments.

Please see the attached Reference Material (3) at the end of this material. I hope you will have a look at it later, because it contains the budgets and financial results by both the old segments and the new segments.

As for operating revenue, as you can see in the upper bar chart, the Urban Development segment will suffer a decline in revenue due to the shrinkage in gains on the sales of buildings and other properties for investors. On the other hand, the Innovation business segment is expected to enjoy an increase in revenue in overseas business, and the Property Management segment will also attain a revenue increase stemming from the expansion of stock under management. Revenue growth of ¥6.9 billion from the preceding year is anticipated.

Now I would like you to turn your attention to the lower chart regarding operating income.

The Wellness segment will see its earnings come down because it posted a cottage sale after the Harvest Club began operation in the previous fiscal year. As with operating revenue, this decline will be covered by the profit growth in the Innovation business and other segments. On a whole, operating income is forecasted to climb by ¥1.7 billion year on year.

|

|

|