|

|

|

|

|

|

|

|

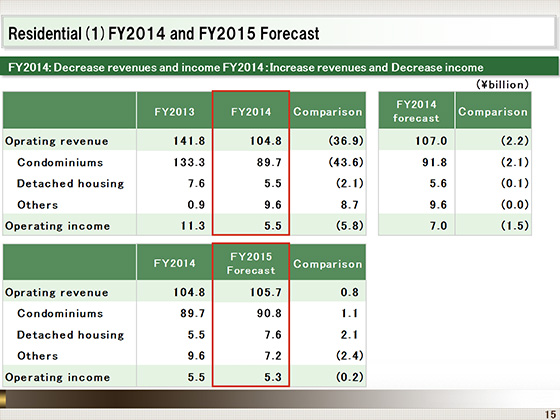

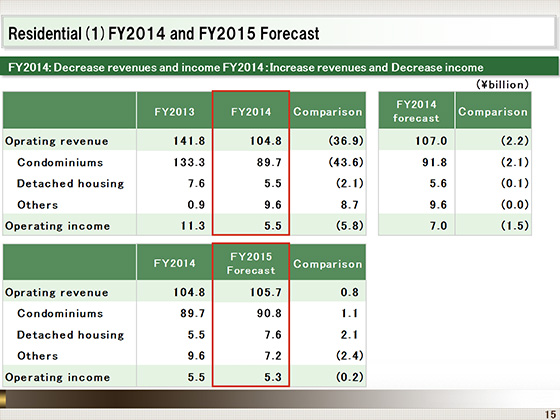

Moving on, we will now look at the Residential segment.

In this segment, operating revenue for the fiscal year ended March 31, 2015 stood at ¥104.8 billion, down ¥36.9 billion year on year, and operating income at ¥5.5 billion, down ¥5.8 billion year on year.

The number of condominium units sold decreased, as did the number of properties in the central Tokyo area. As a result, the average price per unit also fell, causing both revenue and income to decline.

In addition, income was also lower than forecasted because a ¥1.3 billion loss on the valuation of inventories was posted.

For the fiscal year ending March 31, 2016, operating revenue is forecasted to be ¥105.7 billion, which is ¥0.8 billion higher than a year earlier. Operating income is forecasted to be ¥5.3 billion, which is ¥0.2 billion lower.

While the number of condominium units sold will shrink, revenue growth is forecasted because the average price per unit will rise. However, income is projected to drop due partly to a decline in the gross margin ratio.

|

|

|