|

|

|

|

|

|

|

|

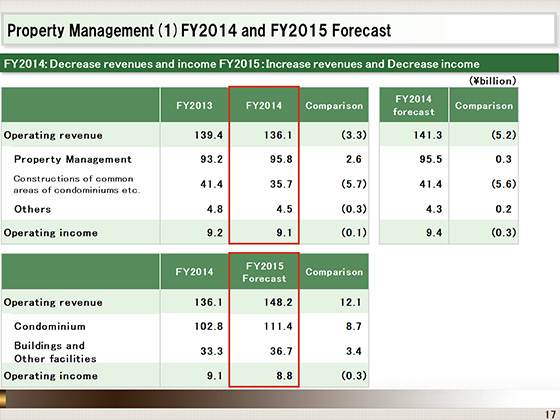

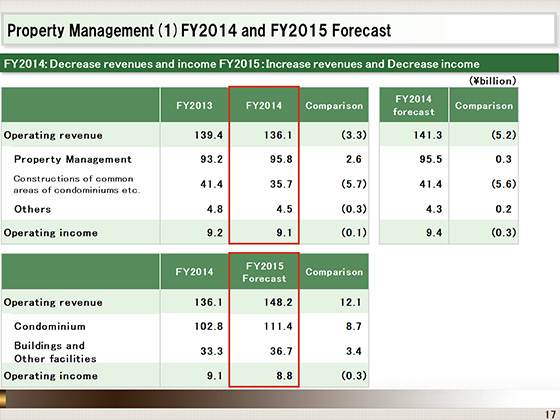

Next, we will discuss the Property Management segment.

For the fiscal year ended March 31, 2015, this segment achieved operating revenue of ¥136.1 billion, with a year-on-year decline of ¥3.3 billion, and operating income of ¥9.1 billion, with a year-on-year decline of ¥0.1 billion.

The growth of stock under management led to greater revenue from contracted management.

However, the reaction to the consumption tax hike and other moves led to a decline in revenue from the construction of common areas in condominiums. As a result, revenue and income both fell.

For the fiscal year ending March 31, 2016, the segment will see operating revenue rise ¥12.1 billion year on year to ¥148.2 billion, and operating income fall by ¥0.3 billion year on year to ¥8.8 billion.

In addition to the growth of stock under management after the merger and acquisition of Tokyu Facility Service Co., Ltd. in April, an increase in the construction of common areas in condominiums will push revenue upwards. Meanwhile, operating income will drop because the costs for future construction and improvements to the management system will rise.

Following the organizational change in Tokyu Community Corp., the new two category revenue classification of condominiums and buildings and others will begin being applied in the fiscal year ending March 31, 2016.

|

|

|