|

|

|

|

|

|

|

|

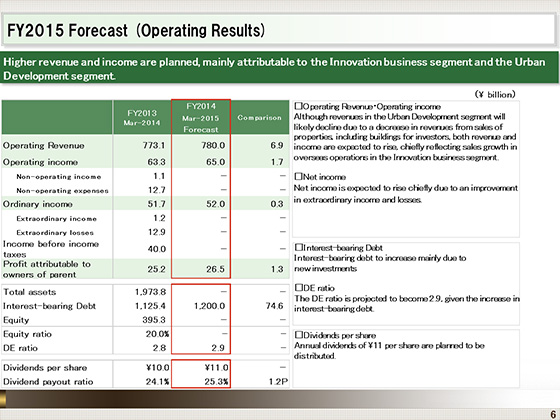

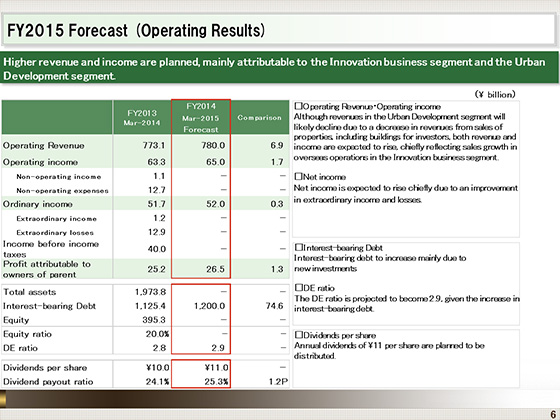

Next, we will discuss our forecast for the fiscal year ending March 31, 2016.

In the fiscal year concerned, our business segments for reporting have been partly changed following an organizational reform. For this reason, the former Business Innovation and Others segment has renamed as the Innovation business segment. Other changes will be explained in segment-specific reviews.

According to the forecast for the fiscal year ending March 31, 2016, operating revenue will stand at ¥780 billion, operating income at ¥65 billion, ordinary income at ¥52 billion, and profit attributable to owners of parent at ¥26.5 billion.

Included in the Innovation business segment, revenue growth is forecasted for overseas business. The Urban Development segment will see an income hike after office buildings and commercial facilities begin operation. According to the forecast, revenue and income will both increase.

At the end of the fiscal year, interest-bearing debt will stand at ¥1,200 billion. After new investments and other items, it will rise ¥74.6 billion from the end of the preceding fiscal year.

The DE ratio will be controlled to ensure that it does not exceed 3. It is forecasted to stand at 2.9.

|

|

|