|

|

|

|

|

|

|

|

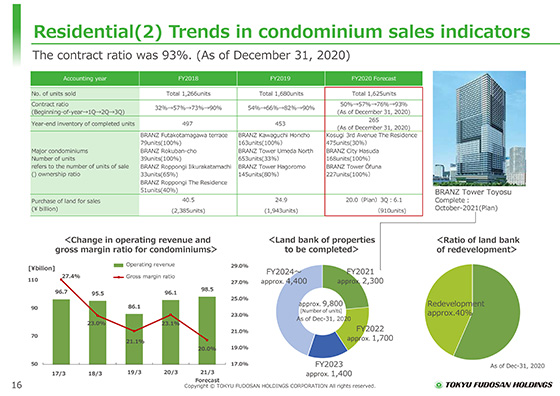

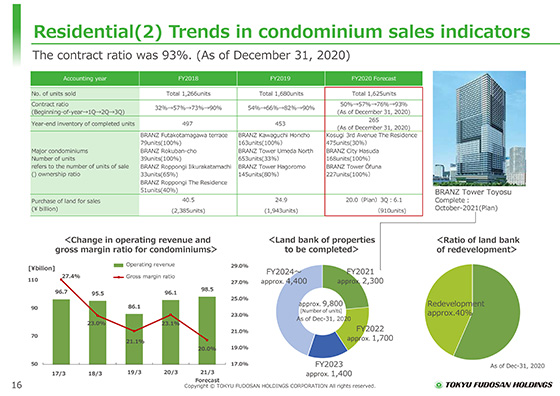

Regarding trends in sales indicators for Condominiums.

For the fiscal year ending March 2021, the number of units sold is expected to be 1,625, a slight decrease from the previous fiscal year, with sales of ¥98.5 billion.

In the first quarter, there were major restrictions on our sales activities, such as the suspension of condominium galleries due mainly to the state of emergency, but currently we are returning to our normal sales activities while limiting the number of visitors to the galleries and providing an online service.

�

The contract rate to condominium sales forecast was steady at 93% as of the end of December.

The inventory of completed units were 265 as of the end of December, and we plan to continue to sell steadily.

As shown in the left-bottom graph, the gross margin ratio of condominiums is planned to be 20% for the fiscal year ending March 2021.

The gross margin ratio for the first nine months was 20%.

We will continue to purchase land under the policy of carefully selecting investments.

The number of land banks scheduled to be recorded on and after the fiscal year ending March 2022 is approximately 9,800, of which redeveloped properties account for about 40%.

Going forward, we will continue to focus on high-value-added redevelopment properties.

|

|

|