|

|

|

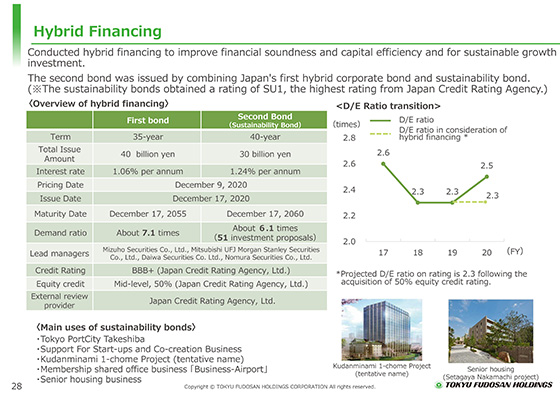

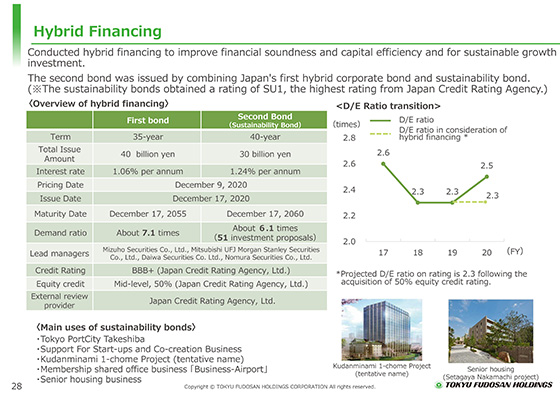

Let me explain hybrid financing.

In November 2020, we announced the implementation of hybrid financing for a total of ¥100.0 billion.

Of this amount, ¥70.0 billion of hybrid corporate bonds were evaluated by corporate bond investors, and conditions were determined on December 9, 2020.

For the second series of bonds, we issued the first sustainability bond through hybrid financing, first time in Japan, taking advantage of our Group's efforts to address environmental and social issues.

For the bonds, capital credit was accredited for the 50% of the funds procured by a rating agency (JCR), and the D/E ratio for the rating is expected to be 2.3 as of the end of fiscal 2020.

The remaining ¥30 billion will be raised in fiscal 2021 with a hybrid loan.

|

|

|