|

|

|

|

|

|

|

|

I will provide an overview of each segment.

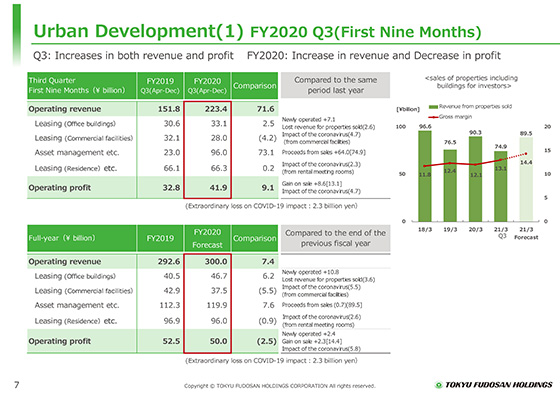

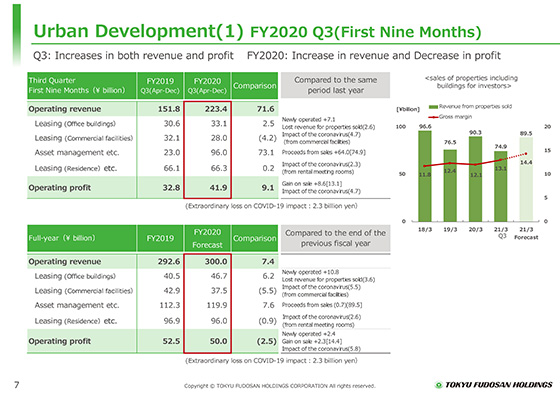

First, the Urban Development segment.

In the first quarter of the fiscal year under review, the commercial facility and rental meeting room businesses were strongly impacted by the COVID-19 pandemic, but revenues and profit increased mainly thanks to the contribution from the sales of buildings to investors.

Since the government again declared a state of emergency in January 2021, the stores in our Group's commercial facilities have been operating shorter hours, closing at 8 p.m. in accordance with requests from the national and local governments.

Regarding revenues from sales of properties including buildings for investors, operating revenue was ¥74.9 billion and gross profit was ¥13.1 billion in the third quarter.

Operating revenue was ¥10.9 billion and gross profit was ¥4.6 billion in the same quarter last year.

Regarding the full-year forecast, revenue is expected to increase mainly due to contributions from Tokyo PortCity Takeshiba, which opened this fiscal year. However, profit is expected to decrease due to the impact of the COVID-19 pandemic on commercial facilities and rental meeting room businesses.

As for gains on the sales of buildings to investors, operating revenue of ¥89.5 billion and gross profit of ¥14.4 billion are expected for the full year.

|

|

|