|

|

|

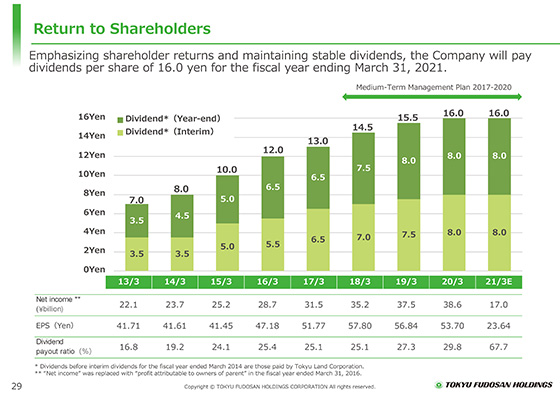

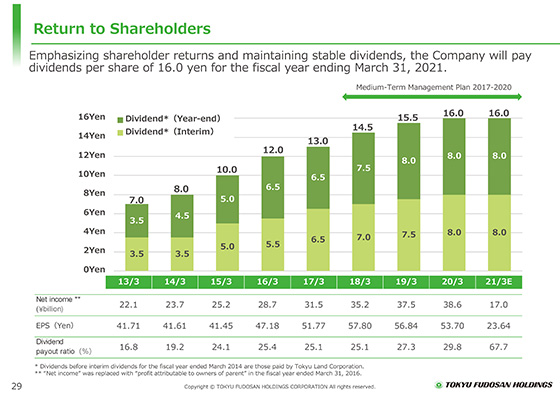

I will explain the return to shareholders.

The basic policy for returns during the current Medium-Term Management Plan period is to continuously provide stable dividends and set the dividend payout ratio at least 25%.

So far, we have adopted a policy of continuously increasing dividends by steadily growing net income.

Although profit is expected to decrease for the fiscal year ending March 31, 2021, we believe that lower profit due to the impact of the pandemic is temporary and we plan to pay dividends of ¥16.0, the same as in the previous fiscal year, with a dividend payout ratio of 67.7%, from the perspective of continuously maintaining stable dividends and focusing on the return to shareholders.

|

|

|