|

|

|

|

|

|

|

|

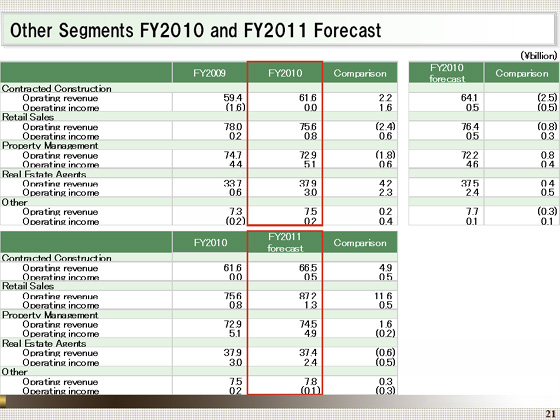

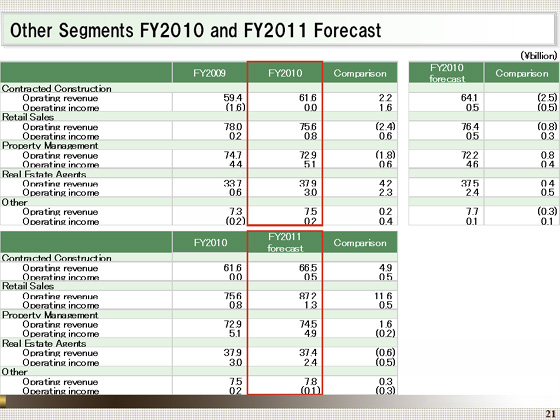

Finally, I'll explain the remainder of the segments.

For Contracted Construction, operating revenue rose ¥2.2 billion year on year, to ¥61.6 billion, while operating income increased ¥1.6 billion from the previous year, to ¥36 million. This higher revenue and income was chiefly attributable to an increase in the number of custom-built houses delivered, and the shifting of revenues from repairs of ¥3.0 billion from the Property Management segment to the Contracted Construction segment, following the reorganization of the Renewal Business Department of Tokyu Community Corporation.

Operating income for the fiscal year ending March 2012 is expected to rise ¥0.5 billion, mainly because of an increase in the construction of common areas in condominiums at Tokyu Community.

Operating revenue in the Retail Sales segment declined ¥2.4 billion year on year, to ¥75.6 billion. Operating income rose ¥0.6 billion, to ¥0.8 billion.

Tokyu Hands Inc., continued to face a challenging situation, with revenues of existing stores (18 major outlets) falling 5.5% on average from the previous fiscal year, although the pace of decline was slowing to 3.7% in the second half of the year, down from 7.2% in the first half. Operating income rose, given the effects of cost cutting initiatives.

We expect an increase of ¥11.6 billion from the previous year in operating revenue and a rise of ¥0.5 billion in operating income for the fiscal year ending March 2012, reflecting the opening of new stores in spring 2011, including the Hakata, Daimaru Umeda, and Abeno stores, as well as an increase in revenues from the existing stores.

Operating revenue in the Property Management segment fell ¥1.8 billion year on year, to ¥72.9 billion, and operating income rose ¥0.6 billion, to ¥5.1 billion.

Taking into account the fact that operating revenues of ¥3.0 billion was shifted to the Contracted Construction segment, as a result of the reorganization of the Renewal Business Department of Tokyu Community Corporation, both revenue and income effectively rose in this segment, principally reflecting an increase in the number of units that we managed.

We expect that operating revenue for the fiscal year ending March 2012 will rise, thanks to a continued increase in the number of units that we manage. However, operating income will fall slightly, given a rise in expenses for improving the quality of services and other products.

Operating revenue in the Real Estate Agents segment rose ¥4.2 billion from the previous year, to ¥37.9 billion, and operating income climbed ¥2.3 billion, to ¥3.0 billion. This higher revenue and income were attributable to an increase in the number of contracts and a rise in average transaction prices in both the retail and the wholesale businesses, as well as steady performance from consignment sales, particularly reflecting strong sales at Futako Tamagawa rise.

We expect that both operating revenue and operating income will fall in this segment in the fiscal year ending March 2012, reflecting the fact that consignment sales benefited from large-scale property orders in the previous fiscal year, offsetting an increase in revenue from real-estate sales agents. |

|

|