|

|

|

|

|

|

|

|

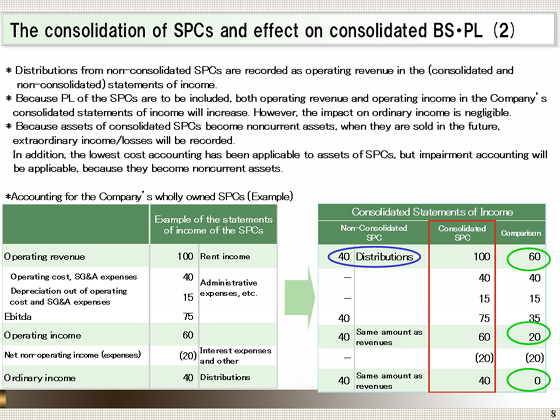

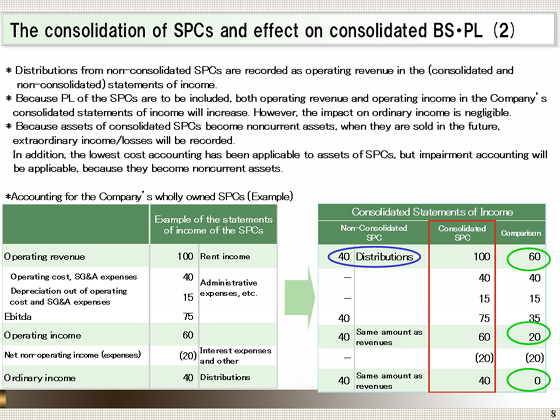

I will now explain the idea of the impact on the statements of income from the inclusion of the SPCs.

Up to the fiscal year ended March 2011 when the SPCs were not included in the consolidated subsidiaries, we reported distributions of 40, marked in the blue circles in the table, as operating revenue in the statements of income. The distributions were calculated by deducting expenses, such as administrative expenses and depreciation and amortization, and interest expenses, from rent income and other income.

From the fiscal year ending March 2012, after the SPCs are included in the consolidated subsidiaries, rent income, expenses, such as administrative expenses and depreciation and amortization, and interest expenses, which are marked in the red box in the table, will be independently reported in the same manner as other noncurrent assets.

As a result, as marked in green circles, compared with the figures stated when the SPCs were not included, operating revenue will rise 60, and operating income will increase 20, which is equivalent to the interest expenses. However, ordinary income will remain unchanged.

In addition, because assets of the consolidated SPCs are reported as noncurrent assets, gains or losses from their sale will be reported as extraordinary income or losses. Consequently, impairment accounting instead of lowest cost accounting will be applicable to the evaluation of assets.

These assets will be included in the leasing and other properties to be disclosed. |

|

|