|

|

|

|

|

|

|

|

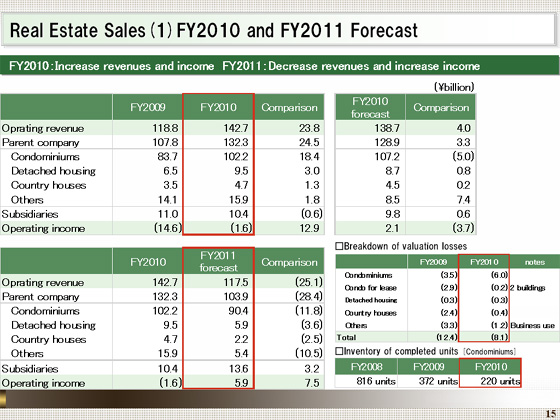

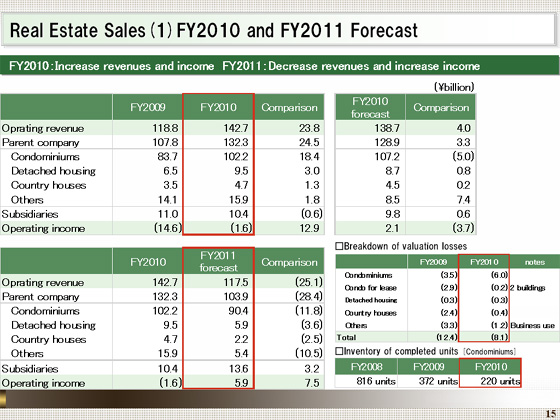

Let me now provide you with a briefing on the Real Estate Sales segment.

In the fiscal year ended March 31, 2011, operating revenue in this segment increased ¥23.8 billion from the previous year, to ¥142.7 billion, while the operating loss stood at ¥1.6 billion; an improvement of ¥12.9 billion from the previous year.

Operating revenue climbed, reflecting an increase in the recorded number of condominium units sold, especially in Futako Tamagawa rise Tower & Residence, where condominiums sold well.

Operating income also rose, mainly because of an improvement in the gross margin in the condominium business, from 7.7% for the previous fiscal year to 12.4% on a basis that excluded the loss on valuation, and a decline in the loss on valuation of inventories from ¥12.4 billion for the previous year to ¥8.1 billion.

With respect to the loss on valuation of inventories associated with condominiums, we believe that all potential losses that can be anticipated at present have already been recorded.

Condominium sales remained favorable. As a result, inventory of completed condominiums steadily declined from its peak of 816 units at the end of March 2009, to 372 units at the end of March 2010 and 220 units at the end of March 2011.

For the forecast for the fiscal year ending March 31, 2012, in the lower column, we expect a ¥117.5 billion operating revenue, down ¥25.1 billion from the previous fiscal year, and ¥5.9 billion in operating income, up ¥7.5 billion year on year.

Operating revenue is expected to fall, given a decline in the number of condominium units sold. Operating income is expected to rise, reflecting an improvement in the gross margin and the absence of a loss on valuation of inventories. |

|

|