|

|

|

|

|

|

|

|

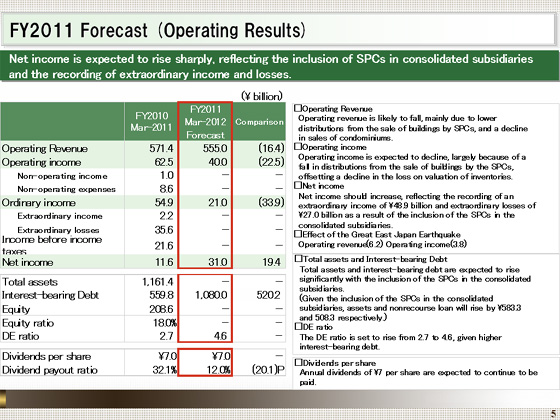

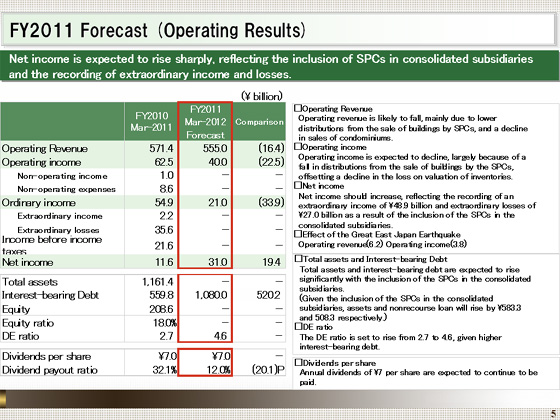

I'll now give you a briefing on our forecast for the fiscal year ending March 31, 2012.

We expect operating revenue to decline ¥16.4 billion from the previous year, to ¥555.0 billion, operating income to fall ¥22.5 billion, to ¥40.0 billion, and ordinary income to decline ¥33.9 billion, to ¥21.0 billion.

Meanwhile, we anticipate that net income in the fiscal year ending March 31, 2012, will increase ¥19.4 billion year on year, to ¥31.0 billion, reflecting the recording of extraordinary income of ¥48.9 billion and extraordinary losses of ¥27.0 billion because of the inclusion of SPCs in consolidated subsidiaries, as I will explain later.

Operating revenue for the fiscal year ending March 2012 is likely to fall, mainly because of the absence of distributions from the Leasing of Real Estate segment, which reached ¥34.0 billion for the fiscal year ended March 2011 from the sale of buildings by SPCs. Another factor will be a decline in the amount of sales of condominiums.

We expect that operating income will decline, mainly on a fall in distributions from the sale of buildings by SPCs in the Leasing of Real Estate segment, offsetting a significant decline in the loss on valuation of inventories in the Real Estate Sales segment.

The forecasts described above include falls of ¥6.2 billion and ¥3.8 billion in operating revenue and operating income, respectively, representing the impact from the Great East Japan Earthquake.

We anticipate that interest-bearing debt will increase ¥520.2 billion year on year, to ¥1,080.0 billion, given an increase of ¥508.3 billion in nonrecourse loans as a result of the inclusion of the SPCs among consolidated subsidiaries. The DE ratio is expected to amount to 4.6.

We plan to pay annual dividend payments of ¥7 per share, the same amount as those paid in the fiscal year ended March 2011. |

|

|