|

|

|

|

|

|

|

|

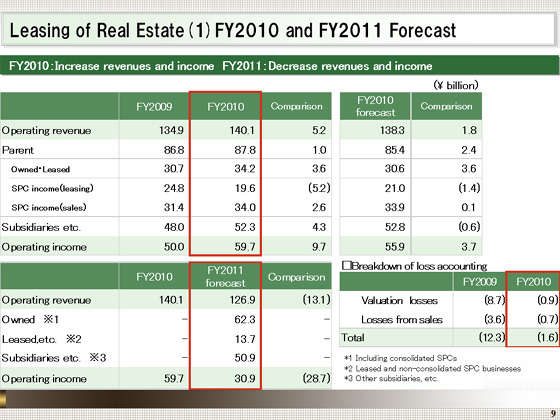

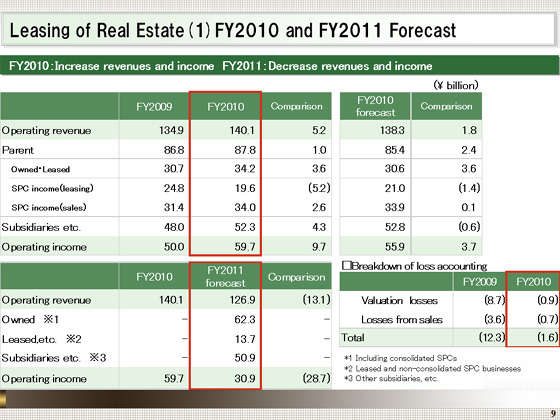

I'll now provide an overview by segment. Let me begin with our performance in the Leasing of Real Estate segment.

Business performance in the fiscal year ended March 31, 2011, was as follows: operating revenue increased ¥5.2 billion from the previous year, to ¥140.1 billion, and operating income increased ¥9.7 billion, to ¥59.7 billion.

The breakdown of operating revenue is as follows: for owned and leased assets, revenue increased year on year primarily because of the change of categories from the assets held by SPCs to owned assets; SPC income declined mainly on lower revenues as a result of sales of buildings in the previous fiscal year, and the change of categories from assets held by SPCs to owned assets. Meanwhile, revenue from distributions from the sale of buildings by SPCs increased primarily because of the sale of 8 properties held by the SPCs. Revenue from subsidiaries, etc. increased, mainly on higher revenues from Tokyu Relocation.

The breakdown of the increase of ¥9.7 billion year on year in operating income is as follows: losses accounting from the assets held by the SPCs amounted to ¥1.6 billion for the fiscal year under review, down from ¥12.3 billion for the previous fiscal year, an improvement of ¥10.7 billion. Distributions from sales of buildings increased to ¥34.0 billion, from ¥31.4 billion for the previous fiscal year, an improvement of ¥2.6 billion, while subsidiaries and other items recorded an improvement of ¥1.3 billion. Meanwhile, passive damages stemming from the disposal of buildings amounted to ¥1.6 billion. The fall in income from existing buildings stood at ¥1.6 billion, and the increase in expenses and other items rose ¥1.6 billion. As a result, operating income increased ¥9.7 billion year on year.

The forecast for the fiscal year ending March 31, 2012, shown in the lower column, is as follows: operating revenue is down ¥13.1 billion from the previous year, to ¥126.9 billion, while operating income is down ¥28.7 billion year on year, to ¥30.9 billion.

The breakdown of expected operating income in the next fiscal year is as follows. The absence of distributions from the sale of buildings will negatively affect income ¥34.0 billion, although we expect an increase in income of ¥10.9 billion year on year because interest expenses due to the consolidation of SPCs will be recorded as non-operating expenses. The absence of loss accounting will boost income ¥1.6 billion; however, income from existing buildings will deteriorate by ¥3.4 billion. As a result, operating income is expected to fall ¥28.7 billion.

Operating revenue of owned properties, including those of the consolidated SPCs, are presented as "owned" in the slide for the fiscal year ending March 2012. |

|

|