|

|

|

|

|

|

|

|

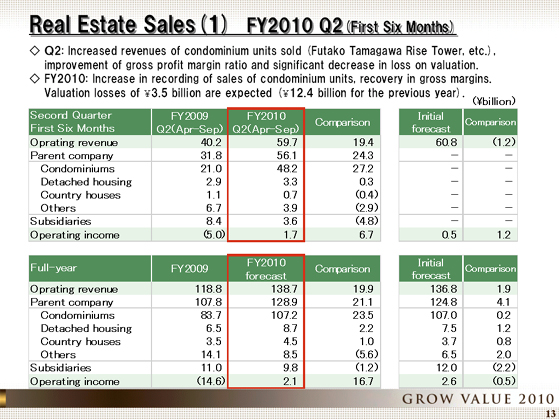

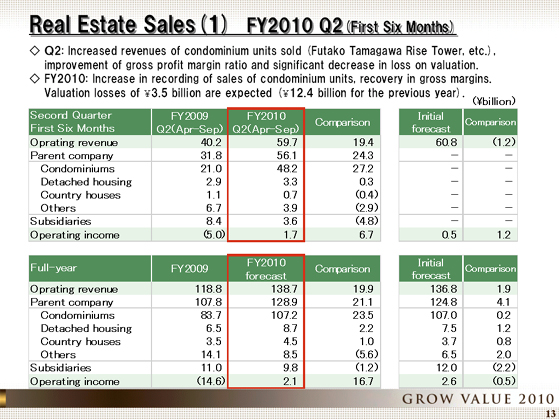

Next, let me explain the Real Estate Sales segment.

In the first six months of fiscal 2010, operating revenue rose ¥19.4 billion year on year, to

¥59.7 billion, and operating income increased ¥6.7 billion, to ¥1.7 billion.

Operating revenue climbed, reflecting an increase in the recorded number of condominium units sold, especially in Futako Tamagawa rise Tower & Residence, where condominiums sold well. The gross margin in the condominium business improved to 10.4%.

The loss on valuation of inventories declined sharply, to ¥1.4 billion from ¥4.6 billion in the first half of the previous year.

Condominiums sold well, and the inventory of completed units was reduced sharply from

372 units at the end of March 2010 to 167 units at the end of September.

We are beginning to be able to raise sales prices little by little, depending on the location of the property.

In September, the Company started to sell condominium units in the resort condominium Atami Seisui. Units in the condominium sold very well, with competition for units reaching as high as 16 to 1.

For the fiscal year ending March 2011, we forecast operating revenue of ¥138.7 billion,

up ¥19.9 billion year on year, and operating income of ¥2.1 billion, rising ¥16.7 billion, as shown in the lower table.

We expect that both operating revenue and income will increase, reflecting a recovery in the number of condominiums sold and a sharp decrease in valuation losses, from ¥12.4 billion in the previous fiscal year to ¥3.5 billion.

|

|

|