|

|

|

|

|

|

|

|

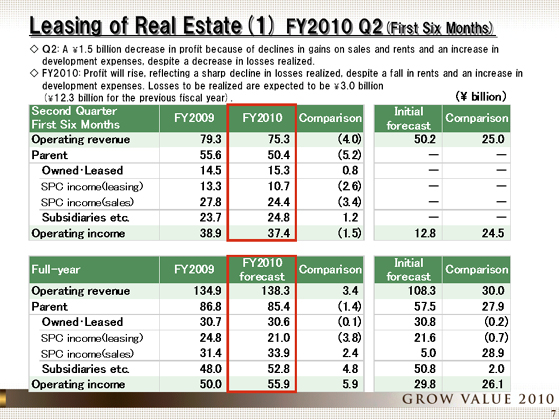

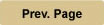

Let me describe the performance of the Lasing of Real Estate segment first.

Operating revenue stood at ¥75.3 billion, down ¥4.0 billion year on year, in the first six months of the fiscal year ending March 2011. Operating income was ¥37.4 billion, declining ¥1.5 billion.

Of the operating revenue, revenue from Owned, Leased properties rose, reflecting the new contributions of Saclass Totsuka and Totsuka Tokyu Plaza. SPC income (leasing) fell, attributable to a decrease due to the sale of buildings in the previous fiscal year, the shift of Shibuya Tokyu Plaza revenue from SPC income to revenue from owned properties, and deteriorating revenues from existing buildings. Dividends from the sale of buildings by SPCs dropped as a result of the sale of significant share of the equity in the Shiodome Building in the previous fiscal year.

The main factors in the ¥1.5 billion decrease in operating income included a decrease in losses realized of ¥5.4 billion, which fell from ¥5.9 in the first half of the previous fiscal year to ¥0.5 billion, primarily in local offices and commercial facilities owned through SPCs. It also reflected a decline of ¥3.4 billion in dividends from the sale of buildings by SPCs, lost earnings of ¥1.3 billion due to the sale of buildings owned or leased, or owned through SPCs, a ¥1.1 billion fall in revenue from existing buildings, and an increase of ¥1.0 billion in development expenses.

As shown in the lower table, we forecast operating revenue of ¥138.3 billion, rising ¥3.4 billion from the previous year, and operating income of ¥55.9 billion, rising ¥5.9 billion, for the fiscal year ending March 2011.

We expect factors to boost operating income, including a rise in dividends from the sale of buildings by SPCs and a sharp fall in losses to be realized and factors to reduce operating income, including earnings lost through the sale of buildings, deteriorating earnings from the existing buildings, and an increase in development expenses.

Specifically, we plan to post dividends from the sale of buildings by SPCs of ¥33.9 billion, a rise of ¥2.4 billion from the previous year. We expect losses of ¥3.0 billion in SPCs, an increase of

¥1.5 billion from the initial plan, and a substantial decrease from ¥12.3 billion in the previous fiscal year, improving ¥9.3 billion.

On the other hand, we forecast lost earnings of ¥1.6 billion due to the sale of buildings owned or leased and buildings of SPCs, a decrease in earnings from the existing buildings of ¥2.0 billion, and a rise in development expenses of ¥2.3 billion. We forecast a ¥5.9 billion increase in operating income in total.

|

|

|