|

|

|

|

|

|

|

|

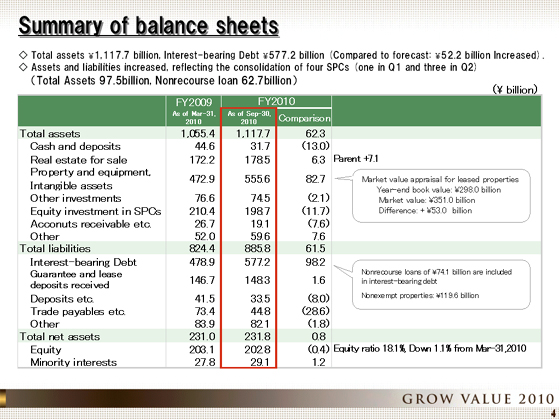

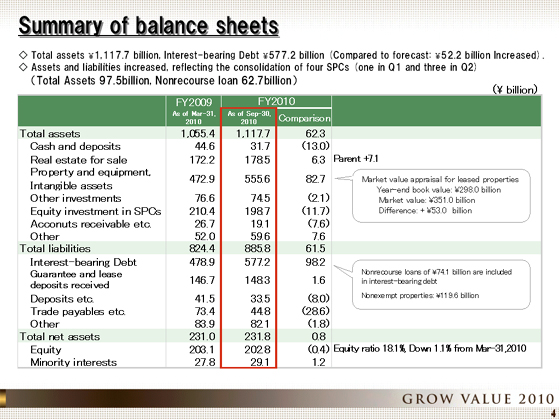

I will move on now to a description of the balance sheet at the end of the second quarter.

Total assets at the end of September rose ¥62.3 billion from the end of the previous fiscal year, to ¥1,117.7 billion.

As announced on September 28, the Company made three new SPCs (silent partnership) its consolidated subsidiaries, and as a result, property, plant and equipment, and interest-bearing debt all increased.

Since the Company consolidated an SPC in the first quarter, it has consolidated four SPCs and six buildings in the fiscal year ending March 2011.

The consolidation of six buildings added ¥94.4 billion to property, plant and equipment, which rose ¥82.7 billion, reflecting the addition and declines including an impairment loss associated with golf courses and depreciation.

With the consolidation of SPCs, investments in the SPCs were eliminated from the consolidated balance sheet. As a result, equity investment in SPCs fell ¥11.7 billion from the end of the previous fiscal year, to ¥198.7 billion.

Of liabilities, interest-bearing debt increased ¥98.2 billion from the end of the previous fiscal year, which amount included a rise of ¥62.7 billion associated with nonrecourse loans of the consolidated SPCs.

Interest-bearing debt of ¥577.2 billion included nonrecourse loans of ¥74.1 billion.

Of net assets, equity was mostly unchanged at ¥202.8 billion. The equity ratio fell to 18.1%, reflecting an increase in total assets.

|

|

|