|

|

|

|

|

|

|

|

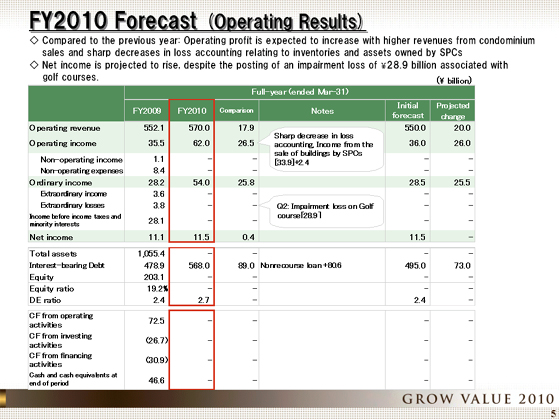

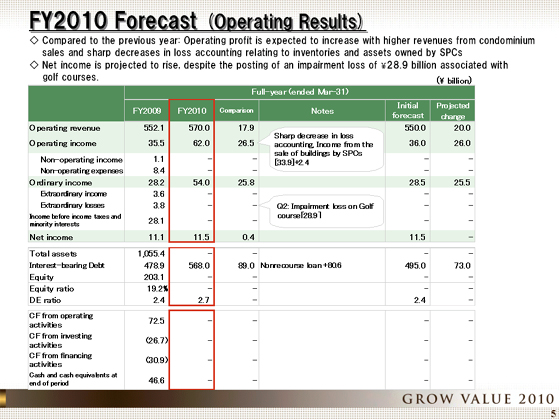

Let me outline the results forecast for the fiscal year ending March 2011.

As announced on September 28, we forecast increases from the previous year both in revenue and profit: operating revenue of ¥570.0 billion, operating income of ¥62.0 billion, ordinary income of ¥54.0 billion, and net income of ¥11.5 billion.

We forecast that operating revenue will rise; reflecting increases in revenues from condominium units to be sold, and income will increase, attributable partly to a sharp fall in the loss on valuation of inventories and assets held through SPCs as in the first half of the fiscal year.

Although the Company posted an impairment loss of ¥28.9 billion in the first half in association with its decision to spin off its golf course business, we expect that net income will also rise.

In comparison with the initial forecast, we expect that operating revenue will rise ¥20.0 billion, reflecting an increase in dividends through the sale of buildings by SPCs and other factors, and that operating income and ordinary income will increase, attributable to a climb in dividends through the sale of buildings by SPCs, despite increases in losses on valuation in the Real Estate Sales segment and the Leasing of Real Estate segment.

The net income forecast remains unchanged from the initial forecast, reflecting the posting of an impairment loss.

Interest-bearing debt will climb ¥89.0 billion from the end of the previous fiscal year, to ¥568.0 billion, with the consolidation of SPCs.

As a result, we expect the DE ratio to stand at 2.7. |

|

|