|

|

|

|

|

|

|

|

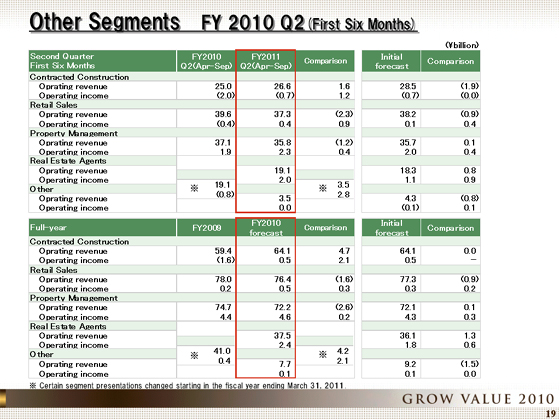

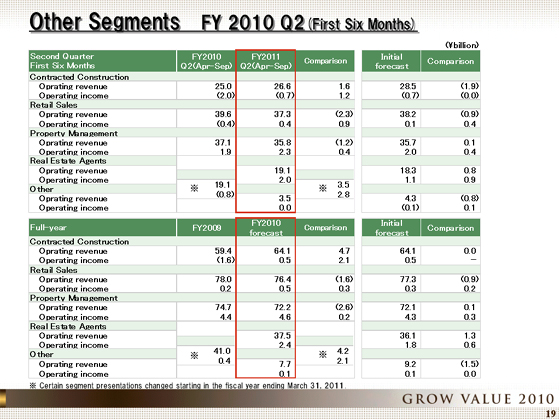

I will be moving on to Other segments.

Operating revenue rose ¥1.6 billion year on year, to ¥26.6 billion in Contracted Construction. The operating loss in the segment improved ¥1.2 billion, to ¥0.7 billion. The operating loss was reduced because of the rise in revenue that reflected an increase in the number of custom-built houses delivered and cost cutting.

With the reorganization of the Renewal Business Department of Tokyu Community Corporation, revenues from repairs of ¥1.3 billion shifted from the Property Management section to the Contracted Construction segment. As orders for reconstruction alternative products in our renovation business expanded steadily, we are aiming to record operating income of ¥0.5 billion in the full year.

Operating revenue in the Retail Sales segment declined ¥2.3 billion year on year, to ¥37.3 billion. Operating income rose ¥0.9 billion, to ¥0.4 billion.

Tokyu Hands Inc. continued to face a challenging situation as revenues at its 18 major outlets declined 7.2%, a sharper decline than expected, in a sluggish consumption environment. However, we secured a profit by cutting costs.

While continuing to cut expenses, we will make preparations for opening new outlets in the second half, including smaller hands be stores and the Hakata, Daimaru Umeda, and Abeno stores, which will open next spring.

Sales fell ¥1.2 billion year on year, to ¥35.8 billion, and operating income rose ¥0.4 billion,

to ¥2.3 billion in the Property Management segment. As the condominium market shrank, we expanded our stock steadily, increasing the number of units that we manage under the designated manager system, including public housing units. As I mentioned in my description of the Contracted Construction segment, operating revenue of ¥1.3 billion was shifted to the Contracted Construction segment with a change in the work execution system of Tokyu Community Corporation. Given that, both revenue and income rose effectively in this segment.Seeking to continue expanding the stock and cutting expenses, we plan to increase income in the full year.

Operating revenue stood at ¥19.1 billion, and operating income was ¥2.0 billion in the Real Estate Agents segment. Considering that the segment was the Real Estate Agents and Other segment in the previous fiscal year, both revenue and income rose from the previous year. Revenue from real-estate sales agents climbed, reflecting a rise in the number of contracts in the retail business, especially in the Tokyo area and increases in prices. Revenue from consignment sales also rose, attributable to strong sales, particularly in Futako Tamagawa rise. We will seek to expand revenue steadily by increasing the number of contracts in the retail sales business against a background of firm consumer demand for housing. At the same time, we will bolster our efforts in the wholesale business, which has begun to show signs of a recovery, to take advantage of business opportunities.

Other segments, which have been separated from the Real Estate Agents segment, include the contract welfare business.

|

|

|