|

|

|

|

|

|

|

|

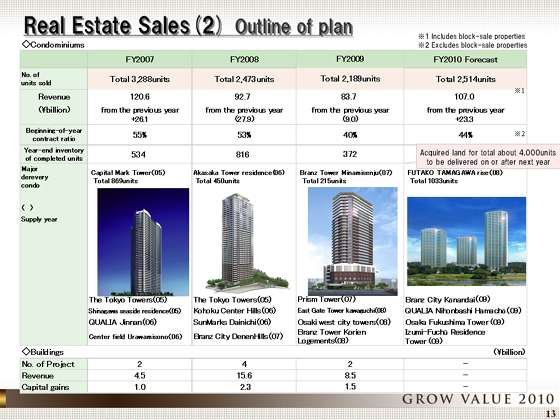

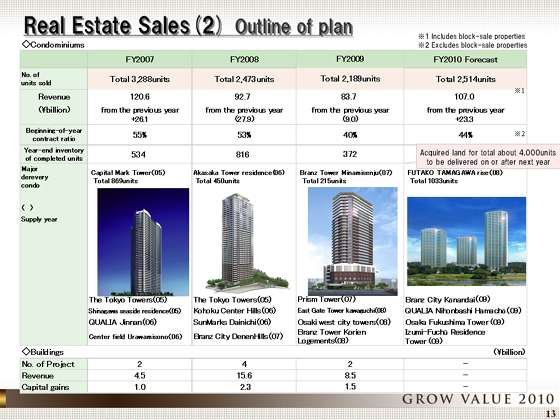

I'll now give you an overview of our plan for condominiums for sale.

In the fiscal year ended March 31, 2010, non-consolidated revenues of ¥83.7 billion, or a total of 2,189 units, was posted.

In the fiscal year ended March 31, 2010, gross margins after excluding valuation losses declined sharply, to about 8% from 16% in the previous fiscal year, primarily because of properties that failed to contribute to income as a result of being included in valuation losses in the previous fiscal year. However, we believe that the income level has hit bottom in the fiscal year under review.

For the fiscal year ending March 31, 2011, the Company hopes to achieve non-consolidated sales of ¥107.0 billion, or 2,514 units. We expect to sell units in popular projects such as Futako Tamagawa rise and Branz Konandai, but with certain projects that still face difficulties in making income contributions we expect a 10% gross margin in the fiscal year ending March 31, 2011.

Our plans also include the disposal of block-sale condominiums in the fiscal year ending March 31, 2011. The percentage of condominiums with signed contracts in all condominiums sales, excluding block-sale condominiums, is 44%.

Condominiums scheduled for posting from the fiscal year ending March 31, 2012, which are already arranged (pipelines), have a total of 4,000 units.

For the fiscal year ended March 31, 2010, ¥8.5 billion in revenue and ¥1.5 billion in income were posted for buildings for sale. However, no such sales are expected for the plan for the fiscal year ending March 31, 2011.

|

|

|