|

|

|

|

|

|

|

|

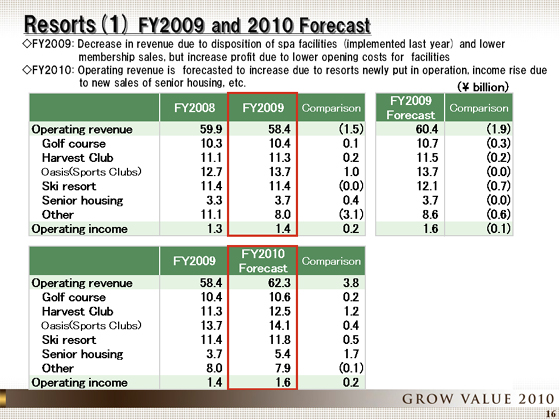

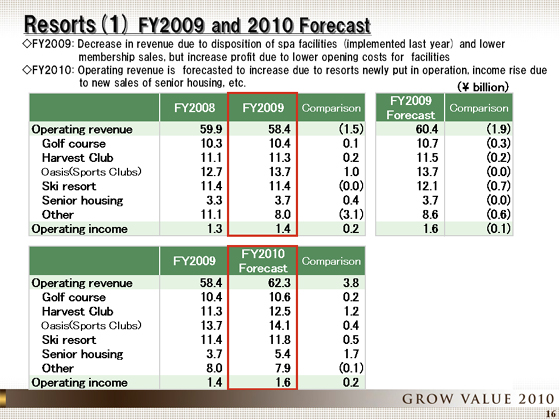

Now I'll explain our performance in the Resorts segment.

Results in this segment in the fiscal year ended March 31, 2010 is as follows: operating revenue dropped ¥1.5 billion from the previous year , to ¥58.4 billion, while operating income rose ¥200 million year on year, to ¥1.4 billion.

The breakdown of operating revenue is as follows: sales increased in all of the following businesses due to the contributions made by new facilities consisting of a golf course, our membership resort hotel Harvest Club, an Oasis sports club and senior housing. However, operating revenue declined year on year due to the decrease in sales of membership registration fees and the disposal of bathing facilities in the previous fiscal year.

Operating income increased year on year because of favorable sales of Grancreer Center Minami senior housing and the decrease in opening expenses as many facilities newly opened in the previous fiscal year.

For the fiscal year ending March 31, 2011, which is shown in the lower column, we project operating revenue of ¥62.3 billion, up ¥3.8 billion from the previous year , and operating income of ¥1.6 billion, up ¥200 million.

The contributions of new facilities and new sales of senior housing are expected to continuously contribute to operating revenue. Operating income is expected to increase primarily because of sales of senior housing and positive effects of improvements to existing facilities.

|

|

|