|

|

|

|

|

|

|

|

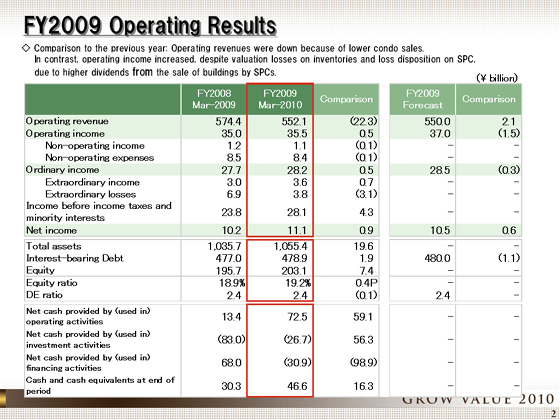

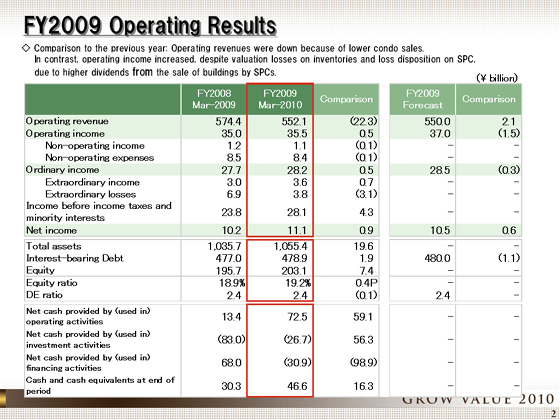

I'd like to begin by providing an overview of the financial results for the fiscal year ended March 31, 2010.

Operating revenue declined ¥22.3 billion from the previous fiscal year to ¥552.1 billion, while operating income increased ¥500 million year on year to ¥35.5 billion. Ordinary income increased ¥500 million, to ¥28.2 billion.

Operating revenue decreased from the previous year primarily due to decreased condominium sales. Yet operating income rose year on year as the posting of dividends from the sale of buildings by SPCs, which amounted to ¥31.4 billion, offset the lower condominium profitability and losses in the Real Estate Sales and Leasing of Real Estate segments.

A breakdown of the losses is as follows: a ¥12.4 billion valuation loss in the Real Estate Sales segment and a ¥5.8 billion real loss, for total loss of ¥18.2 billion; in the Leasing of Real Estate segment, a ¥8.7 billion valuation loss, a ¥3.6 billion loss on disposal, for a total of ¥12.3 billion; so that in both segments losses totaled ¥30.5 billion.

In extraordinary items, the Company posted a ¥3.6 billion extraordinary profit from the gain on sales of fixed assets, with a ¥3.8 billion extraordinary loss from impairment.

Compared to the previous fiscal year, extraordinary profit/loss improved by ¥3.8 billion. Yet partly because of the increase in tax-related expenses, net income stood at ¥11.1 billion, which was up ¥900 million from the previous fiscal year.

Year-end interest-bearing debts also rose ¥1.9 billion from the previous year , to ¥478.9 billion. This result, however, is lower than the forecast by ¥1.1 billion, while the DE ratio stood at 2.4, almost the same as the forecast.

|

|

|