|

|

|

|

|

|

|

|

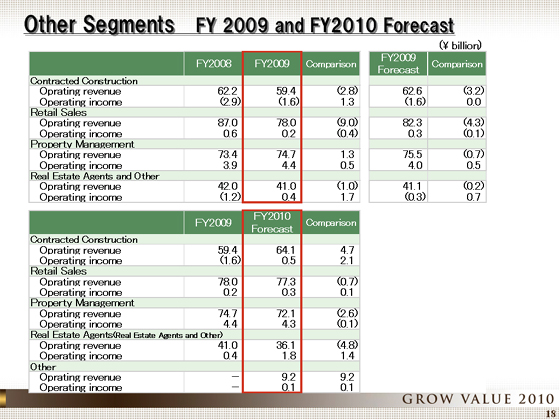

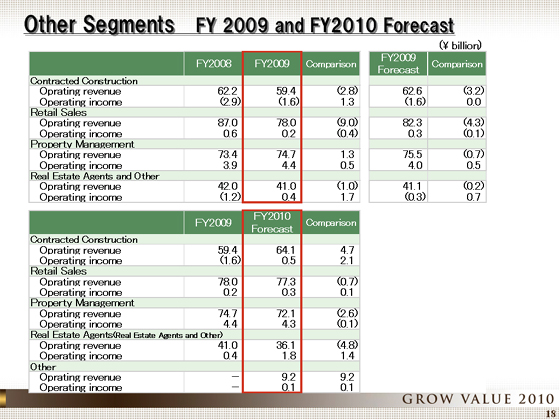

Finally, I'll explain the rest of the segments.

For Contracted Construction, operating revenue declined ¥2.8 billion year on year, to ¥59.4 billion, while the operating loss stood at ¥1.6 billion; an improvement of ¥1.3 billion. With the market still sluggish, we stepped up restructuring at subsidiaries and cost cutting to reduce the negative balance. Since the fall of 2009, orders for order-made housing and renovation have been expanding, and we aim to return to profit; with a ¥500 million operating income in the fiscal year ending March 31, 2011.

Incidentally, because of the change in the operation execution system for the construction of common areas in condominiums at Tokyu Community, operating revenue of ¥3.9 billion and operating income of ¥200 million were transferred to the Contracted Construction segment from the Property Management segment.

In Retail Sales, operating revenue stood at ¥78.0 billion, down ¥9.0 billion from the previous fiscal year, while operating income decreased ¥400 million, to ¥200 million. At the existing Tokyu Hands stores, the percentage of revenue decrease was 10.7%, far worse than the forecast, as the consumption environment did not recover. Despite these harsh conditions, efforts for cost reduction were stepped up and profit was secured.

During the fiscal year ending March 31, 2011, we will continue to reduce cost, while striving to develop new businesses such as the small-sized hands be shops, and the new stores in Hakata, Daimaru Department Store Umeda, and Abeno; which are scheduled to open in spring of 2011.

In the Property Management segment, operating revenue increased ¥1.3 billion from the previous year , to ¥74.7 billion, while operating income also increased ¥500 million, to ¥4.4 billion. Despite the significant shrinking of the market for condominiums for sale, we steadily expanded our stock, such as the number of managed public housing properties in the designated property manager system, etc. and achieved increases in both revenues and income.

During the fiscal year ending March 31, 2011, as we explained in the Contracted Construction segment, operating revenue of ¥3.9 billion and operating income of ¥200 million were transferred to the Contracted Construction segment from the Property Management segment. For this reason actual operating revenue and operating income increased year on year.

In the Real Estate Agents and Other Business segment, operating revenue fell by ¥1.0 billion, to ¥41.0 billion, and operating income increased ¥1.7billion from the previous year , to ¥400 million. Operating revenue decreased with the decline in sales outsourcing, but operating income increased thanks to cost cutting and other factors. The real estate agents business is steady, as the number of sold units in retailing increased and selling prices have bottomed out. On the whole, however, this segment has not fully recovered. In the near future we plan to steadily expand sales in retailing in order to seize more business opportunities for the entire segment.

The decrease in operating revenue in the fiscal year ending March 31, 2011 is due to the separation of the Other Business segment, and we expect an actual increase in both operating revenue and operating income in the Real Estate Agents segment.

The Other Business segment to be spun-off includes outsourced welfare and benefit programs.

|

|

|