|

|

|

|

|

|

|

|

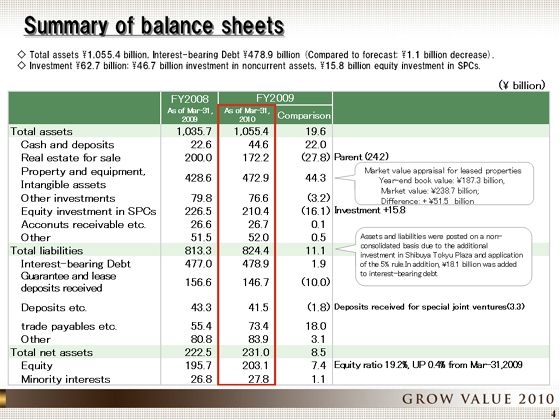

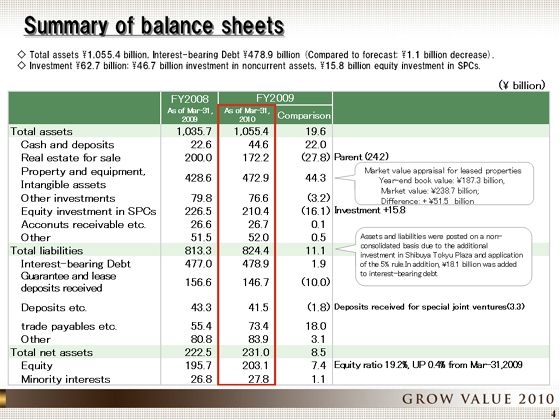

Next I will provide an overview of the year-end balance sheet.

Total assets as of March 31, 2010, increased ¥19.6 billion from the previous year , to ¥1,055.4 billion.

In the asset segment, inventory and equity investments declined year on year primarily due to disposal.

Property and equipment, intangible assets increased ¥44.3 billion from the previous fiscal year due to new investments of ¥46.9 billion such as Tozuka Tokyu Plaza and senior housing, and accounting for purchasing back of the Shibuya Tokyu Plaza, while deducting the decrease of ¥13.2 billion depreciation, etc.

The Company sold Shibuya Tokyu Plaza to SPC, which still maintains ownership. Since the Company made an additional equity investment in SPC in the fiscal year ended March 31, 2010, however, the transaction was accounted for in compliance with the "Practical Guidelines Concerning the Accounting of Alienator Relating to Real Estate Fluidization that Utilizes Special-Purpose Companies," (Accounting System Council Report No. 15 dated July 31, 2000), that deems that the Company purchased back the property. As a result, the property was posted on a non-consolidated basis in both the asset and liability segments.

In the liability segment, interest-bearing debt increased from the end of the previous fiscal year by ¥1.9 billion, to ¥478.9 billion. This was ¥1.1 billion lower than the forecast. Interest-bearing debt includes the ¥18.1 billion in borrowing for the Shibuya Tokyu Plaza.

For net assets, equity capital increased ¥7.4 billion year on year, to ¥203.1 billion.

In addition, for "Market value of leased properties," which is to be disclosed at the end of the fiscal year ended March 31, 2010, appraised market value stood at ¥238.7 billion against the year-end book value of ¥187.3 billion, with an appraisal gain of ¥51.5 billion.

It should be noted, however, that non-consolidated SPCs are not covered.

|

|

|