|

|

|

|

|

|

|

|

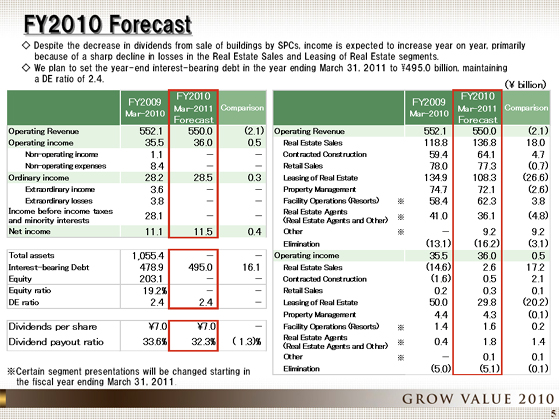

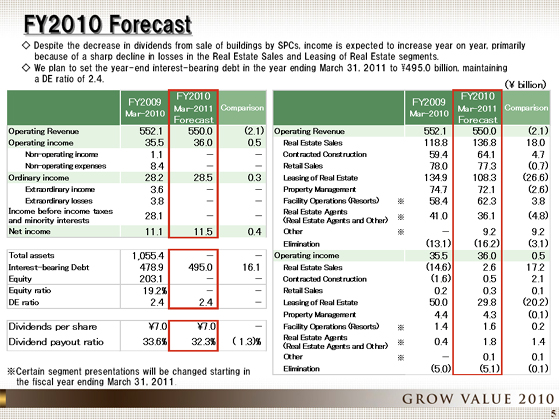

I'll now give you a briefing on our forecast for the fiscal year ending March 31, 2011.

Though we expect operating revenue to decline ¥2.1 billion from the previous year to ¥550.0 billion, we expect that our income will increase on the year-on-year basis for the second consecutive fiscal year as we forecast operating income to increase ¥500 million to ¥36.0 billion, and ordinary income to increase ¥300 million to ¥28.5 billion. As a result, we expect net income in the fiscal year ending March 31, 2011, to increase ¥400 million year on year, to ¥11.5 billion.

For operating revenue, despite the expected decrease in dividends from the sale of buildings by SPCs in the Leasing of Real Estate segment from ¥31.4 billion in the fiscal year ended March 31, 2010, to ¥5.0 billion in the fiscal year ending March 31, 2011, we expect that sales of condominiums will sharply increase. As a result, operating revenue is expected to remain almost unchanged.

For operating income, loss accounting is expected to significantly decrease, while an improvement is expected in the Real Estate Sales, Contracted Construction and Real Estate Agents and Other Business segments, which are expected to result in increased income. Incidentally, we expect to post ¥1.5 billion valuation loss in the Leasing of Real Estate segment in the fiscal year ending March 31, 2011.

We also expect to post a negative ¥2.0 billion extraordinary income/loss.

Interest-bearing debt is expected to slightly increase, to ¥495.0 billion, at the end of the fiscal year ending March 31, 2011, while the DE ratio will be unchanged at 2.4. For dividend payment, we plan to pay ¥7 for the full fiscal year, unchanged from the amount of dividend in the fiscal year ended March 31, 2010.

Please note that we plan to change the categorization of certain segments starting in the fiscal year ending March 31, 2011. Specifically, the Resorts segment will be renamed to Facility Operation, while the Real Estate Agents and Other Business segment will be separated into Real Estate Agents segment and Other segment.

|

|

|