|

|

|

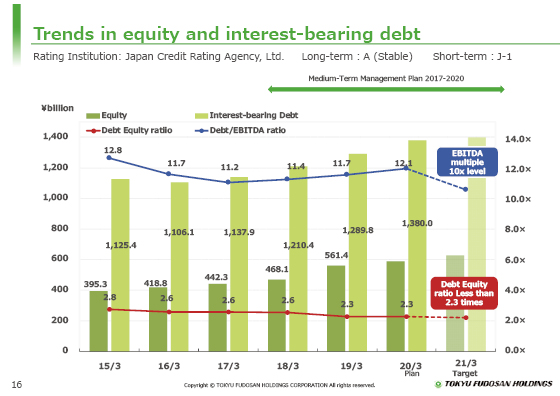

I will now explain the changes in equity and interest-bearing debt.

In the fiscal year ended March 31, 2019, interest-bearing debt increased 79.4 billion yen, to 1,289.8 billion yen, due to new investments and other requirements. The D/E ratio decreased to 2.3 times through an increase in equity, mainly as a result of the capital increase through public stock offering.

We expect that interest-bearing debt will increase by 90.2 billion yen to reach 1,380 billion yen in the fiscal year ending March 2020 due to investments in Shibuya and other large redevelopment projects and new and other projects. The D/E ratio, however, is expected to remain the same at 2.3 times.

In January this year, JCR raised our long-term issuer rating from A- to A.

|

|

|