|

|

|

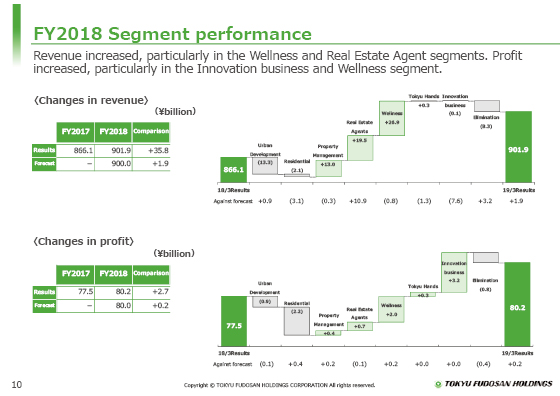

Next, I would like to explain the changes in operating revenue and operating profit by segment.

As the top graph shows, operating revenue increased 35.8 billion yen from the previous year, mainly due to the strong result of the Property Management and Real Estate Agent segments, delivery of the co-ownership shares of Tokyu Harvest Club Karuizawa & VIALA, and the operation of new Tokyu Stay hotels and their full-year contribution.

The operating profit presented in the bottom graph increased 2.7 billion yen from the previous year as a result of the sale of overseas properties and the posting of housing in Indonesia in the Innovation business segment, in addition to growth in the Property Management, Real Estate Agent, and Wellness business segments.

I will explain the specific details of each segment later.

|

|

|