|

|

|

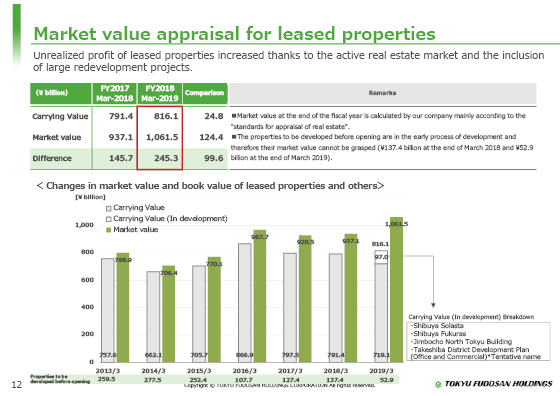

I will now explain the market value appraisal for leased properties.

The book value of leased properties such as office buildings and commercial facilities as of the end of March 2019 was 816.1 billion yen, and their market value was 1,061.5 billion yen. The difference (unrealized gain) was therefore 245.3 billion yen, and we are continuing to see growth in the unrealized gain.

The graph below the table shows changes in the market prices and book values of leased properties.

The market value appraisal excludes properties being planned and not yet operated, whose market values are difficult to estimate. The four properties shown on the lower right side, including Shibuya Solasta, are included in the appraisal because we can now estimate their market values.

|

|

|