|

|

|

|

|

|

|

|

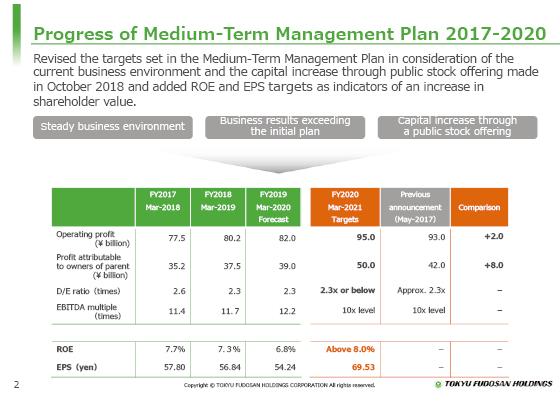

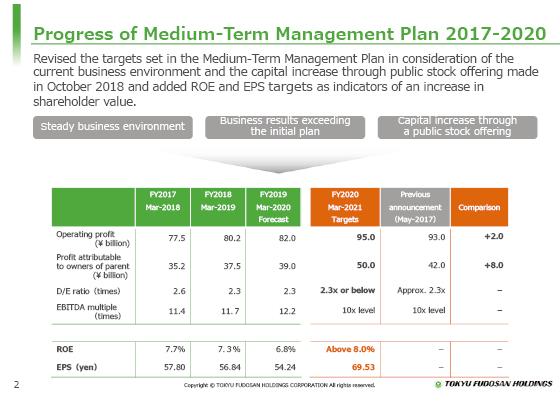

I will first describe how we have revised our Medium-Term Management Plan and our policy for planned activities in consideration of the revision.

We have just completed the first two years of our four-year Medium-Term Management Plan and revised the numerical targets for the fiscal year 2020, which is the final year in the plan, taking into account the steady business environment, including the active office market, business results exceeding our initial plan, capital increase through the public offering implemented in October 2018, and other factors.

The key points in the revision can be broadly divided into two.

One is upward revisions of forecasts for the fiscal year 2020.

We have added 2 billion yen to the target operating profit to make it 95 billion yen and have added 8 billion yen to the target profit attributable to owners of parent to make it 50 billion yen. The target D/E ratio, which was originally set to be approximately 2.3 times, was set to 2.3 times or below.

The other point is that we have added ROE and EPS as new indicators of an increase in shareholder value.

We have set an ROE of above 8% and an EPS of 69.53 yen as the targets for the fiscal year 2020.

I will explain these in detail from the next page.

|

|

|