|

|

|

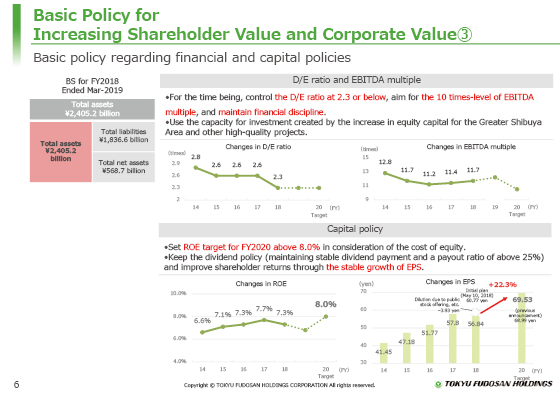

Next, I will explain how we should consider the liability and net asset side in the total assets of approximately 2,400 billion yen for the fiscal year ended March 2019.

As for the D/E ratio and EBITDA multiple, we will control the D/E ratio at 2.3 times or below, aim for the 10x-level in the EBITDA multiple, and maintain financial discipline.

In addition, we will use the capacity for investment created by the increase in equity capital for the Greater Shibuya Area and other high-quality projects.

For the capital policy presented in the lower section of the page, we will set the ROE target for the fiscal year 2020 above 8.0% in consideration of the cost of equity and improve shareholder returns through the stable growth of EPS.

As a result of this revision, we expect that EPS in fiscal year 2020 will exceed the forecast before the capital increase through public stock offering, and the value diluted by the capital increase will be recovered in the final fiscal year.

|

|

|