|

|

|

|

|

|

|

|

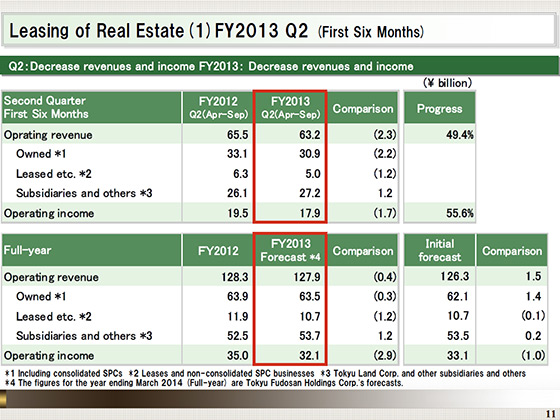

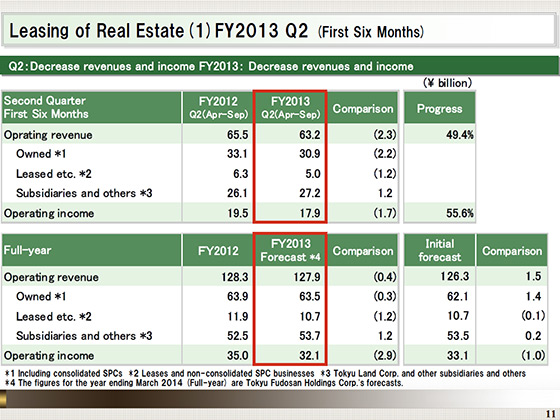

I will now provide an overview by segment. Let me begin with our performance in the Leasing of Real Estate segment.

Our performance in the first six months of the fiscal year ending March 31, 2014, was as follows: operating revenue declined ¥2.3 billion year on year, to ¥63.2 billion, and operating income fell ¥1.7 billion year on year, to ¥17.9 billion.

Of the year-on-year decrease in operating revenue of ¥2.3 billion, positive factors included a ¥1.3 billion increase as a result of the new operation of the Shin-Meguro Tokyu Building, etc., and a ¥1.2 billion increase in revenue at subsidiaries, etc. However, there were negative factors, such as a ¥2.5 billion decline that was partly due to the sale of properties to a REIT, a ¥0.5 billion decline attributable to lower rents from existing buildings, and a ¥1.2 billion decline in revenue from fees, which resulted in a ¥2.3 billion decrease in revenue year on year.

Of the ¥1.7 billion year-on-year decrease in operating income, a positive factor was a ¥0.9 billion increase, reflecting the operation of new buildings. However, there were the same negative factors as those for operating revenue, including a ¥1.3 billion decline that was partly due to the sale of properties to a REIT and a ¥0.5 billion decrease attributable to lower rents from existing buildings, which resulted in a ¥1.7 billion decrease in income year on year.

As shown in the lower table, for the fiscal year ending March 31, 2014, we forecast operating revenue of ¥127.9 billion, a decrease of ¥0.4 billion from the previous year, and operating income of ¥32.1 billion, falling ¥2.9 billion.

With respect to the factors for the ¥2.9 billion decline in operating income from the previous fiscal year, while we expect operating income to increase by ¥1.8 billion due to the operation of new buildings, we anticipate a ¥1.3 billion decline from the previous year due to the sale of properties to a REIT, a ¥0.9 billion decline attributable to lower rents from existing buildings and decrease in fee income, among other factors, as well as loss write-offs, which are expected to be on the same level as the previous fiscal year.

|

|

|