|

|

|

|

|

|

|

|

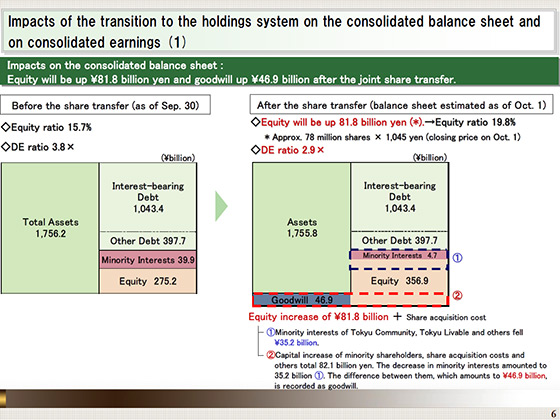

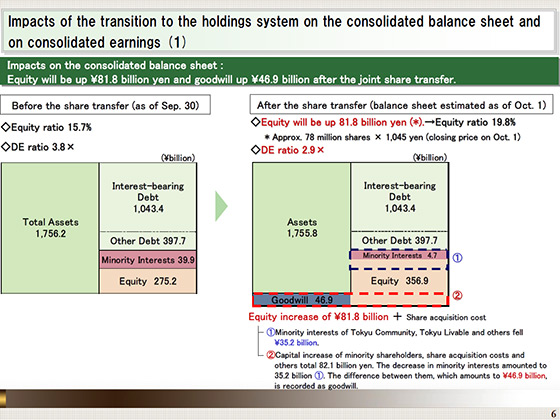

I would like to explain the impact of this move to a holdings system on the consolidated balance sheet and profit and loss.

Regarding the impact on the balance sheet, the equity in Tokyu Fudosan Holdings' balance sheet will increase by ¥81.8 billion from the value of Tokyu Land Corporation's consolidated balance sheet as of the end of September 2013, which is shown on the left. This value was obtained by multiplying the approximately 78 million shares that were allocated to the minority shareholders of Tokyu Community Corporation and Tokyu Livable, Inc. in the share transfer, by ¥1,045, which was the closing price of a share of Tokyu Fudosan Holdings on October 1.

The balance sheet, estimated as of October 1, is shown on the right side. First of all, as shown in the blue part (1), the book value of the minority interests in Tokyu Community, Tokyu Livable, etc. will decrease by ¥35.2 billion. Then, as shown in the red part (2), ¥46.9 billion is posted in the assets section as goodwill. This value is the difference between ¥82.1 billion, the value obtained by adding the share acquisition cost to ¥81.8 billion, which is the amount of the equity increase, and ¥35.2 billion, which is the amount of the decrease in the book value of minority interests.

As a result of the above, the DE ratio will fall to 2.9, and the equity ratio will be improved to 19.8%.

|

|

|