|

|

|

|

|

|

|

|

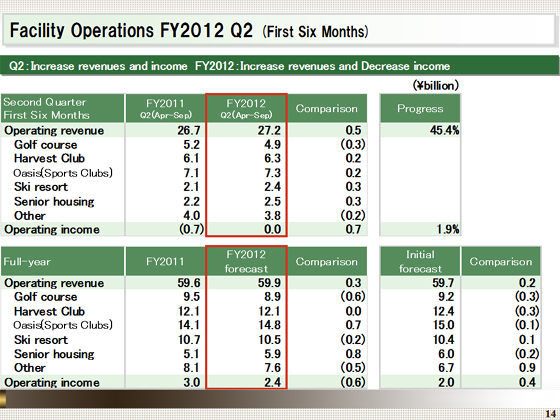

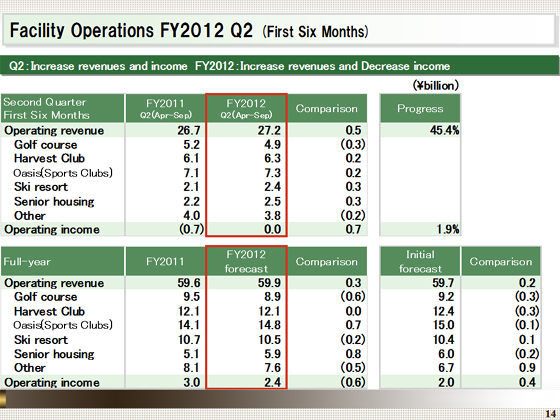

Let me now move on to describe the Facility Operations segment.

Results in this segment for the first six months of the fiscal year ending March 2013 were as follows: operating revenue increased ¥0.5 billion year on year, to ¥27.2 billion, while operating income was up ¥0.7 billion, to ¥4.5 billion.

Both revenues and income increased, reflecting improved occupancy in senior housing and more effective operation of fitness clubs, in addition to a recovery in the number of visitors to our membership resort hotel Harvest Club and ski resorts, which had declined in the previous fiscal year in the wake of the Great East Japan Earthquake. ��For the fiscal year ending March 2013, we expect operating revenue to increase ¥0.3 billion year on year, to ¥59.9 billion, and operating income to decline ¥0.6 billion, to ¥2.4 billion, as shown in the lower table. ��We expect revenues to increase, as we anticipate higher occupancy of senior housing facilities and an improvement in operations at Tokyu Sports Oasis, among other factors, while we forecast an effective increase in income, if excluding compensation payments of ¥1.5 billion by Tokyo Electric Power Company recorded in the previous fiscal year. |

|

|