|

|

|

|

|

|

|

|

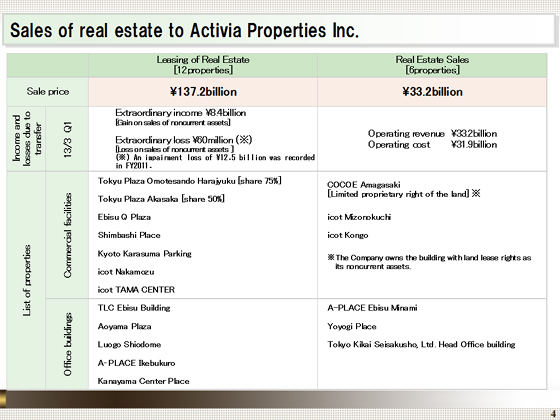

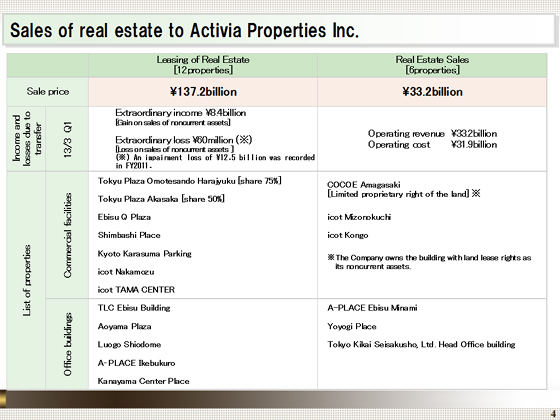

Next I will summarize once again the transfer of assets to Activia Properties Inc., which was conducted on June 13.

�Commercial facilities and office buildings owned by the Company and its consolidated SPCs were sold to Activia Properties Inc. when it was listed. The total sales price was ¥170.4 billion, consisting of ¥137.2 billion for 12 properties owned by the Leasing of Real Estate segment as property and equipment and intangible assets and ¥33.2 billion for six properties owned by the Real Estate Sales segment as inventory.

�The Company recorded extraordinary income of ¥8.4 billion and extraordinary losses of ¥60 million as a result of the transfer of property and equipment and intangible assets, as well as operating revenue of ¥33.2 billion and operating cost of ¥31.9 billion as a result of the transfer of inventory. In the previous fiscal year, the Company posted ¥12.5 billion as an impairment loss associated with the transfer of property and equipment and intangible assets.

�Although the Company regards the REIT business as one of the key strategies in its medium-term management plan, it seeks to develop the TLC Group and the REIT together by pursuing recycling-based reinvestment and supporting the internal and external growth of the REIT, with the aim of growing the assets of the Group, to generate stable, high quality operating income such as fee income. |

|

|