|

|

|

|

|

|

|

|

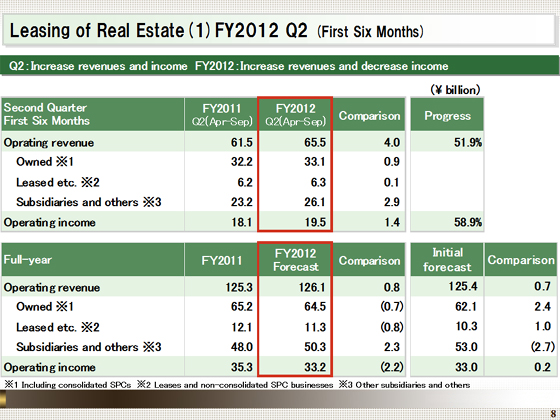

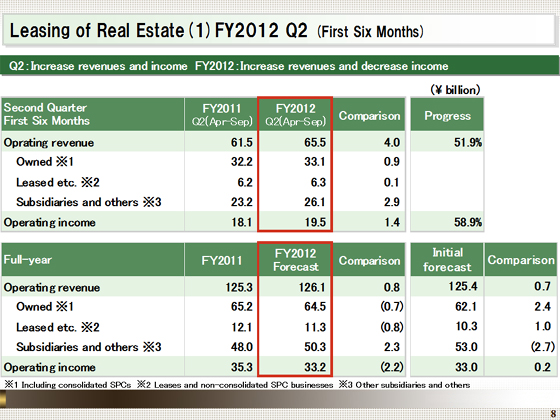

Let me explain the performance of the Leasing of Real Estate segment first.

�Operating revenue stood at ¥65.5 billion, up ¥4.0 billion year on year, in the first six months of the fiscal year ending March 2013. Operating income was ¥19.5 billion, increasing ¥1.4 billion year on year.

�Of the ¥4.0 billion increase in operating revenue, major negative factors were a ¥1.8 billion decline due to the sale of properties to a REIT and a ¥0.6 billion decline attributable to lower rent from existing buildings, offset by positive factors such as a ¥3.0 billion increase, reflecting the new operation of Tokyu Plaza Omotesando Harajuku and others and a ¥2.9 billion increase primarily due to higher revenues of subsidiaries including REIT-related revenues.

�The major factors for the ?1.4 billion increase in operating income included a ¥1.4 billion increase as a result of the new operation of properties and a ¥1.9 billion increase primarily due to higher income of subsidiaries, among other factors, partly offset by a ¥1.3 billion decline attributable to the sale of properties to a REIT and a ¥0.6 billion decline attributable to lower rent from existing buildings as in operating revenues.

�As shown in the lower table, we forecast operating revenue of ¥126.1 billion, increasing ¥0.8 billion from the previous year, and operating income of ¥33.2 billion, falling ¥2.2 billion, for the fiscal year ending March 2013.

�With respect to the factors for the ¥2.2 billion decline in operating income, we anticipate a ¥2.9 billion fall from the previous year due to the sale of properties to a REIT and a ¥1.2 billion decline attributable to lower rent from existing buildings, among other factors, while we expect operating income to increase ¥1.8 billion with the operation of new buildings. |

|

|