|

|

|

|

|

|

|

|

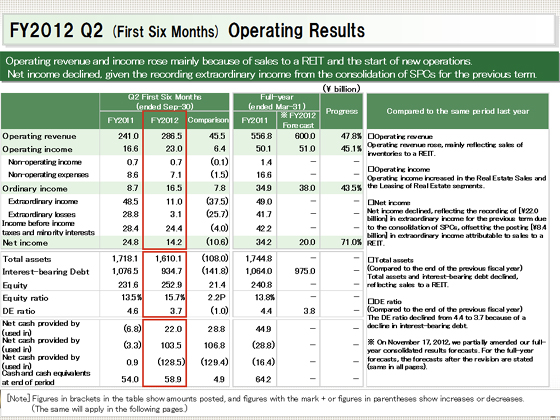

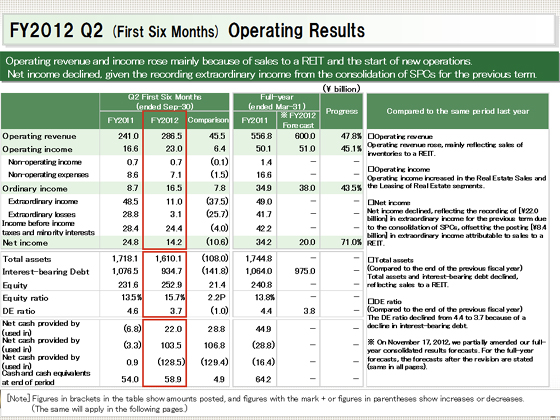

I would like to begin by providing an overview of the financial results for the first six months of the fiscal year ending March 2013.

Operating revenue increased ¥45.5 billion year on year, to ¥286.5 billion, while operating income rose ¥6.4 billion, to ¥23.0 billion. Ordinary income stood at ¥16.5 billion, climbing ¥7.8 billion.

Activia Properties Inc. was listed on the Tokyo Stock Exchange on June 13, 2012.

As the Company transferred commercial facilities and office buildings owned by the Company and its consolidated subsidiaries to a REIT associated with the listing, revenues increased in the Real Estate Sales segment. In this segment, income also increased, mainly because of an improvement in the profit margin on condominiums and a reduction in the loss on valuation of inventories. In the Leasing of Real Estate segment, both revenues and income increased, primarily due to the commencement of operations of new facilities.

Although the Company also recorded a gain on sales of noncurrent assets of ¥8.4 billion as extraordinary income associated with the transfer of assets to a REIT, it also recorded extraordinary income in the same period of the previous fiscal year because of the consolidation of SPCs, among other factors. As a result, net income came to ¥14.2 billion, a fall of ¥10.6 billion year on year. |

|

|