|

|

|

|

|

|

|

|

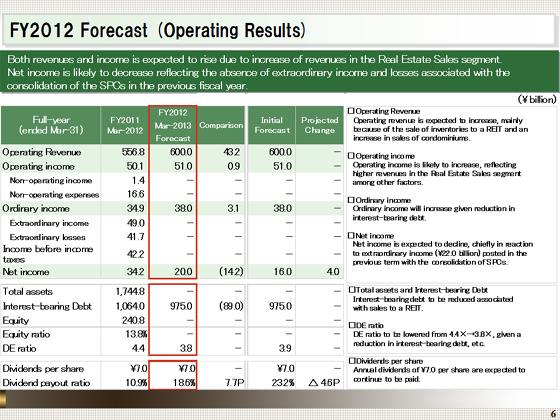

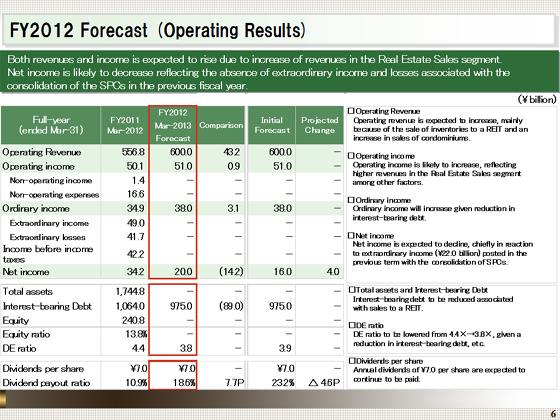

I will now give you a briefing on our forecast for the fiscal year ending March 31, 2013.

We expect operating revenue to be ¥600.0 billion, operating income to be ¥51.0 billion, ordinary income to be ¥38.0 billion, and net income to be ¥20.0 billion.

In the Real Estate Sales segment, we expect that both revenues and income will increase, primarily reflecting the sale of inventory to a REIT, an increase in the sale of condominiums, and a fall in loss on valuation of inventories among other factors.

We expect that net income will decline, given that we recorded net extraordinary income of ¥22.0 billion in the previous fiscal year in association with the consolidation of SPCs, although we anticipate extraordinary income resulting from the sale to a REIT in the first six months of the fiscal year.

In comparison with our initial forecast, we expect that operating revenue, operating income and ordinary income to be on a par with the initial forecast, but we have revised net income upward by ¥4.0 billion from the initial forecast, to ¥20.0 billion, given the posting of net extraordinary income up to the second quarter among other factors.

We anticipate that interest-bearing debt at the end of the current fiscal year will decline ¥89.0 billion from the end of the previous fiscal year, to ¥975.0 billion. As a result, the DE ratio is expected to be 3.8.

The annual dividend per share is expected to be ¥7.0, the same amount as in the fiscal year ended March 2012. |

|

|