|

|

|

|

|

|

|

|

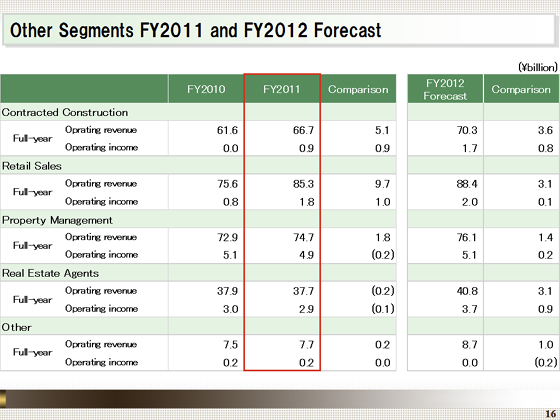

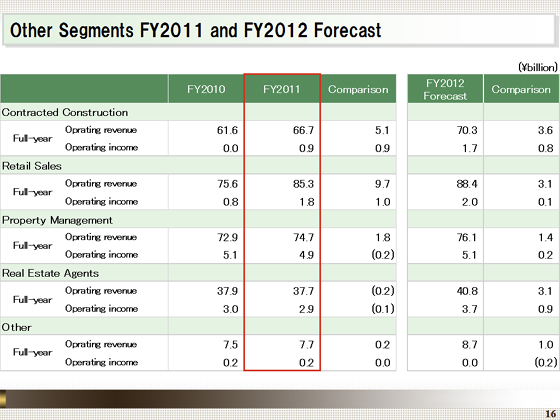

Now, I will move on to explain the remainder of the segments.

For the Contracted Construction segment, operating revenue rose ¥5.1 billion from the previous fiscal year, to ¥66.7 billion, and operating income increased ¥0.9 billion, to ¥0.9 billion.

Both revenues and income were up due in part to an increase in completions of custom-built houses and common areas in condominiums. We anticipate higher revenues and income for the fiscal year ending March 2013, mainly reflecting an increase in renovations.

Operating revenue in the Retail Sales segment increased ¥9.7 billion from the previous fiscal year, to ¥85.3 billion. Operating income rose ¥1.0 billion, to ¥1.8 billion. Tokyu Hands Inc. enjoyed an increase in both revenues and income, supported by the opening of new stores.

In the fiscal year ending March 2013, we will open "Tokyu Hands Tokyo" in September, in addition to "hands be" specialty stores. With these new operations and improvements in existing stores, we anticipate increases in both revenues and income.

Operating revenue in the Property Management segment rose ¥1.8 billion from the previous fiscal year, to ¥74.7 billion, while operating income declined ¥0.2 billion, to ¥4.9 billion.

Revenues increased primarily thanks to a rise in the number of units that we managed at Tokyu Community Corporation, but income fell given an increase in outlays to improve the quality of services and other products.

We anticipate an increase in both revenues and income for the fiscal year ending March 2013 with a continuing rise in the number of units that we manage.

Operating revenue in the Real Estate Agents segment fell ¥0.2 billion from the previous fiscal year, to ¥37.7 billion, and operating income declined ¥0.1 billion, to ¥2.9 billion.

Revenues in the real-estate sales agents business increased as we opened new stores in the retail sales business and stepped up work on large projects in the wholesale business. In the consignment sales business, however, revenues declined due to the absence of sales for large condominiums, such as Futako Tamagawa Rise, which the segment recorded in the fiscal year ended March 2011.

We expect that both operating revenue and operating income will increase in this segment in the fiscal year ending March 2013, reflecting a recovery in the number of properties we handle in the real-estate sales agents and consignment sales businesses.

|

|

|