|

|

|

|

|

|

|

|

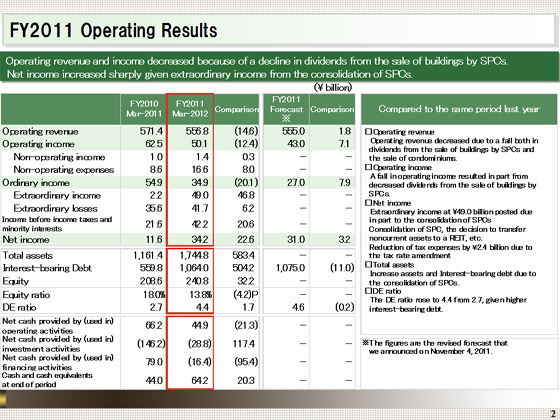

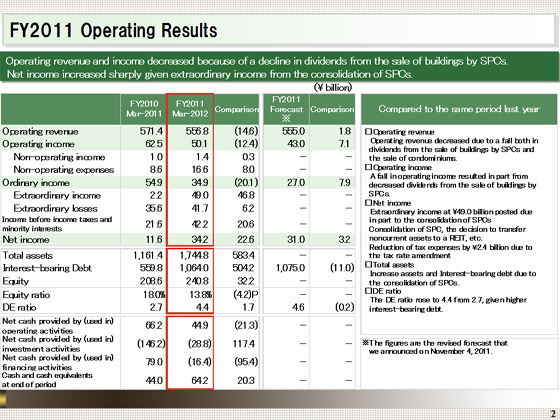

I would like to begin by providing an overview of our financial results for the fiscal year ended March 2012.

Operating revenue declined ¥14.6 billion from the previous fiscal year, to ¥556.8 billion, and operating income decreased ¥12.4 billion, to ¥50.1 billion. Ordinary income stood at ¥34.9 billion, down ¥20.1 billion from the previous fiscal year.

The decline in operating revenue primarily reflected the elimination of ¥34.0 billion of distributions from the sale of buildings by SPCs, which we recorded in the fiscal year ended March 2011, in addition to a fall in the recorded number of condominium units sold. Operating income also decreased, principally attributable to a fall in distributions from the sale of buildings by SPCs.

In comparison with our initial forecast, operating revenue was ¥1.8 billion higher and operating income was ¥7.1 billion higher.

The Company posted extraordinary income of ¥49.0 billion due in part to the consolidation of SPCs in the first quarter. It also posted extraordinary losses of ¥41.7 billion, including an impairment loss of ¥26.4 billion attributable to the consolidation of SPCs and an impairment loss of ¥12.5 billion due to a decision to transfer noncurrent assets to a REIT. However, net income increased significantly, rising ¥22.6 billion from the previous fiscal year, to ¥34.2 billion, on factors including the reduction of tax expenses by ¥2.4 billion with the change in corporate tax rate.

|

|

|