|

|

|

|

|

|

|

|

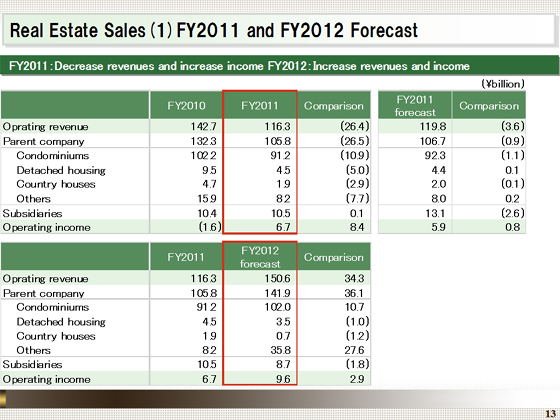

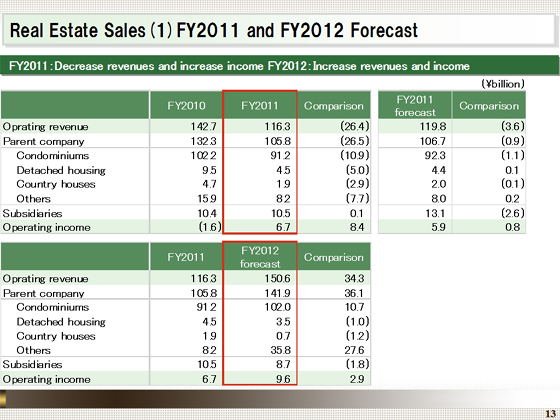

Let me now provide you with a briefing on the Real Estate Sales segment.

In the fiscal year ended March 2012, operating revenue declined ¥26.4 billion from the previous fiscal year, to ¥116.3 billion, and operating income increased ¥8.4 billion year on year, to an operating income of ¥6.7 billion.

Revenues decreased, primarily reflecting a fall in the recorded number of condominium units sold. However, income increased with an improved margin and a decline in the loss on valuation of inventories, among other factors.

The gross margin in the condominium business improved to 17%.

With respect to the forecast for the fiscal year ending March 31, 2013, in the lower column, we expect operating revenue of ¥150.6 billion, up ¥34.3 billion from the previous fiscal year, and operating income of ¥9.6 billion, up ¥2.9 billion year on year.

Both revenues and income are expected to increase, mainly because of the planned sale to a REIT of buildings for sale and commercial facilities that we own as inventories and an increase in revenues resulting from a rise in the per-unit price of condominiums.

|

|

|