|

|

|

|

|

|

|

|

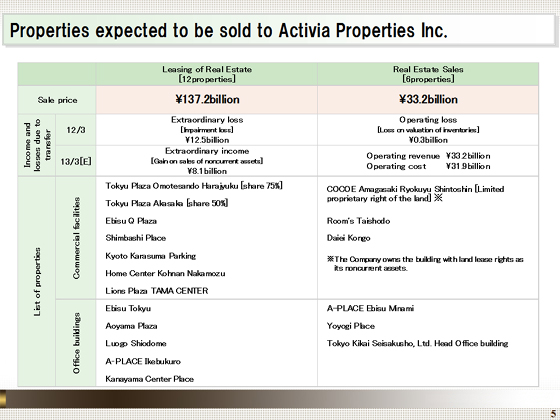

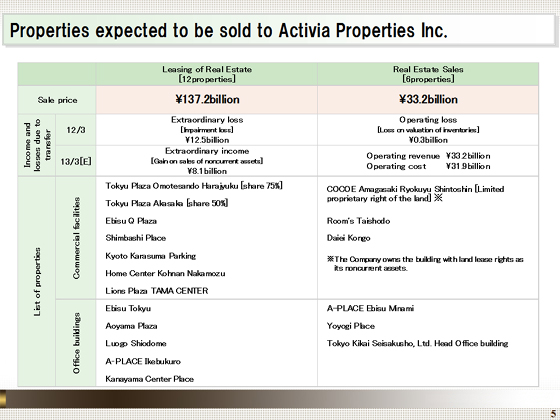

Before moving to a briefing on our forecast for the fiscal year ending March 31, 2013, I would like to explain the transfer of our assets to Activia Properties Inc., which we announced on April 27, 2012.

The sale price will be ¥170.4 billion in total, consisting of ¥137.2 billion for the 12 properties owned by our Leasing of Real Estate segment as noncurrent assets, and ¥33.2 billion for the six properties owned by the Real Estate Sales segment as inventories.

Given the decision on this transfer, we posted extraordinary losses of ¥12.5 billion in the fiscal year ended March 2012.

In the fiscal year ending March 2013, we will post extraordinary income of ¥8.1 billion associated with the transfer of noncurrent assets, operating revenue of ¥33.2 billion, and an operating cost of ¥31.9 billion associated with transfer of inventories.

Because of these transfers, the amount of inventories and noncurrent assets is expected to be reduced by ¥160.8 billion in total in the balance sheet for the fiscal year ending March 2013. |

|

|