|

|

|

|

|

|

|

|

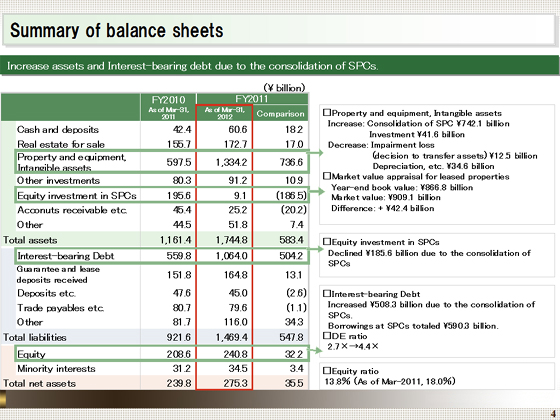

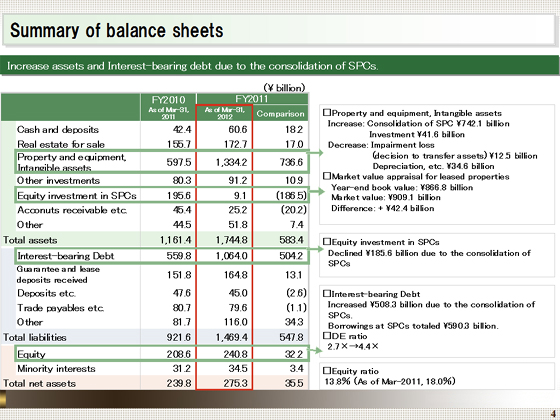

Next I will provide an overview of the balance sheet at the end of the fiscal year.

Total assets at the end of March 2012 rose ¥583.4 billion from the end of the previous fiscal year, to ¥1,744.8 billion.

The consolidation of 29 SPCs in the first quarter added ¥742.1 billion to noncurrent assets. In contrast, equity investment in SPCs declined ¥185.6 billion, as investments in SPCs were eliminated from the consolidated balance sheet, along with the consolidation of the SPCs.

Interest-bearing debt increased ¥504.2 billion from the end of the previous fiscal year, to ¥1,064.0 billion primarily because of the consolidation of the SPCs, and the DE ratio also climbed, rising from 2.7 at the end of March 2011 to 4.4 at the end of March 2012.

Equity was ¥240.8 billion, an increase of ¥32.2 billion from the end of the previous fiscal year, mainly reflecting the posting of extraordinary income and losses associated with the consolidation of the SPCs. However, the equity ratio fell to 13.8% due to an increase in total assets (down 4.2% from 18.0% at the end of the previous fiscal year).

|

|

|