|

|

|

|

|

|

|

|

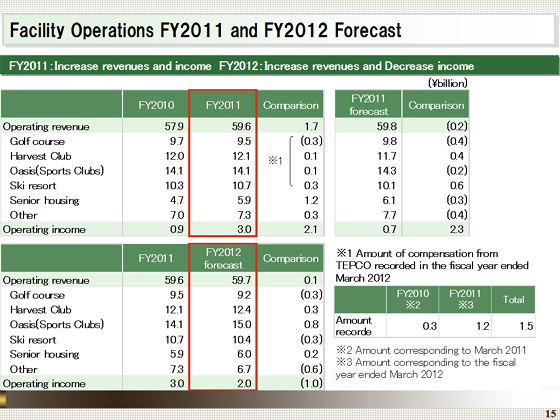

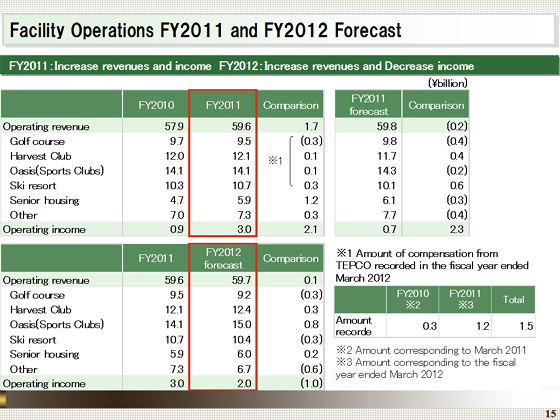

I would now like to move on to describe the Facility Operations segment.

Results in this segment in the fiscal year ended March 2012 were as follows: operating revenue increased ¥1.7 billion from the previous fiscal year, to ¥59.6 billion, while operating income increased ¥2.1 billion, to ¥3.0 billion.

Revenues increased in our seniors housing, thanks to the contributions made by new facilities, while income increased because we cut costs to deal with the impact of the Great East Japan Earthquake.

In the fiscal year ended March 2012, there was a loss of revenues due to the impact of the Great East Japan Earthquake. However, the loss was offset by compensation from Tokyo Electric Power Company, which was ¥1.5 billion.

For the fiscal year ending March 2013, we expect operating revenue to increase ¥0.1 billion year on year, to ¥59.7 billion, and operating income to decline ¥1.0 billion, to ¥2.0 billion, as shown in the lower table.

With regard to operating revenues, while we will continue to expect the nuclear accident to have an impact on our facilities around Fukushima prefecture, we anticipate an increase in revenues, mainly reflecting new operations in our membership fitness club Tokyu Sports Oasis and the occupancy rate improvement of the Harvest Club. We will aim for an increase in real income, excluding compensation from the Tokyo Electric Power Company.

|

|

|