|

|

|

|

|

|

|

|

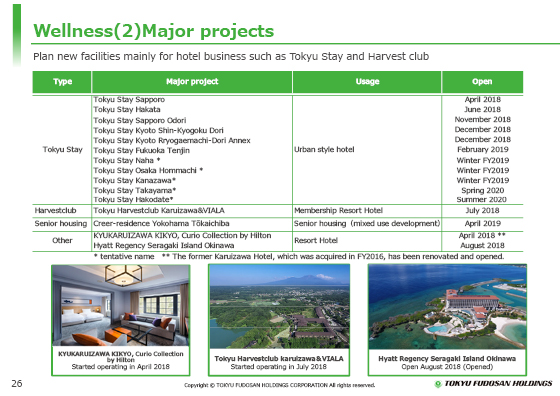

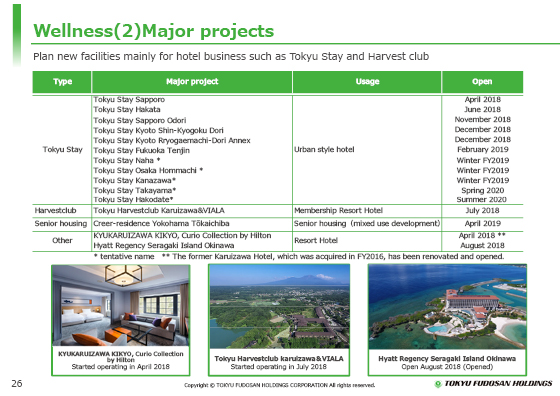

I will now give you an update on the main projects of the Wellness segment.

In Tokyu Stay, two facilities have already opened in Sapporo and Hakata in FY2018, and 21 facilities and 3,136 rooms are currently operated.

In the current fiscal year, Tokyu Stay will open a total of four more facilities in Sapporo (due to open on November 21), Kyoto and Fukuoka.

The segment will promote external growth by accelerating the opening of new facilities in local areas where demand for business use is solid and inbound demand is also firm.

The segment planned to expand the facilities to about 30 and 4,400 rooms by FY2020, the final year of the medium-term management plan, but these plans have come into sight, given that the Tokyu Stay hotels I have mentioned have already achieved 30 facilities and 4,700 rooms.

“Other” includes KYU KARUIZAWA KIKYO Curio Collection by Hilton, a hotel that was opened in April 2018 after renovating the old Karuizawa Hotel that was acquired in FY2016, and Hyatt Regency Seragaki Island Okinawa, which was opened in August 2018. The segment will continue to strengthen its initiatives for the hotel business, leveraging its know-how cultivated in the resort business.

|

|

|