|

|

|

|

|

|

|

|

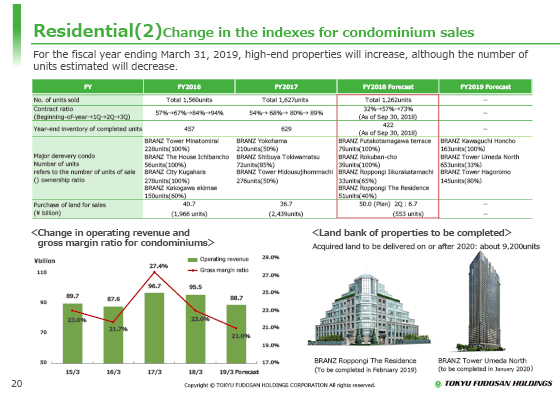

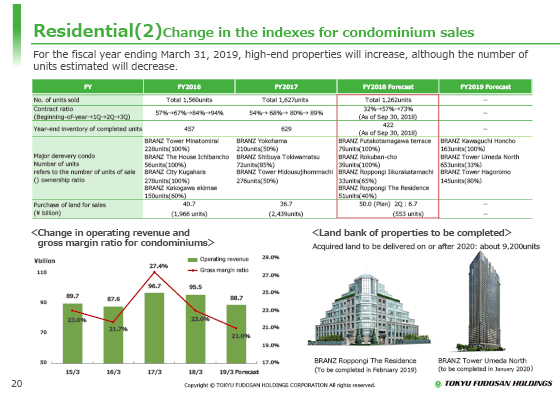

Next are trends in the performance indicators for condominium sales.

In the current fiscal year, the segment is expected to record 1,262 units sold and ¥88.7 billion.

The contract ratio to sales forecast for condominiums made steady progress from 32% at the beginning of the period to 73% as of the end of September. The inventory of completed units also decreased from the end of March 2018 to 422 units at the end of September.

As stated in the value of investment in land in the lower part of the table, the land acquisition was ¥6.7 billion in the second quarter, which is the land for 553 units.

Condominiums delivered that will be posted from the next fiscal year (ending March 31, 2020) are increasing steadily to about 9,200 units, partly due to the redevelopment project in front of Sengakuji Station and our initiatives in reconstruction projects.

The gross margin of condominiums for the fiscal year ending March 31, 2019 at the lower left is estimated to be about 21% in the full year.

The gross margin in the second quarter was about 20% because it was centered on the posting of the inventory of completed units.

We have decided that the status of sales of condominiums remains solid, particularly in properties in central Tokyo and in good locations under the polarizing sales conditions.

|

|

|