|

|

|

|

|

|

|

|

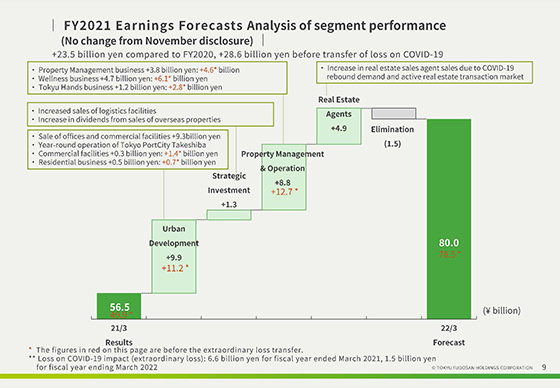

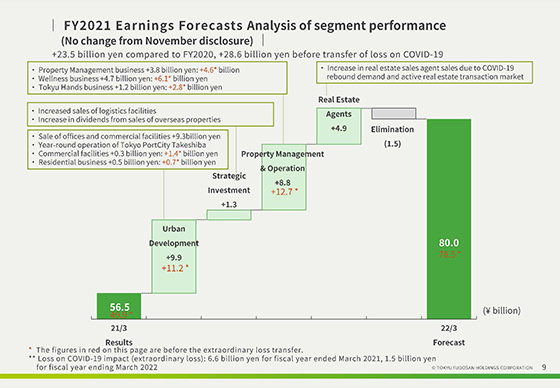

We will provide a per-segment explanation on the factors behind the increases in operating profit in our full-year forecast. Note that there has been no change from our announcement in November.

Regarding operating profit for this fiscal year and the previous fiscal year and the indications in red under the Urban Development business and Property Management & Operation business segments, values in cases where transfers were not made to loss on COVID-19 impact (extraordinary loss) are indicated.

Overall, operating profit increased by 23.5 billion yen year on year, or by 28.6 billion yen prior to transfer to loss on COVID-19 impact. We are forecasting an increase in profit for all segments.

In the Urban Development business segment, we are forecasting an increase in profit of 9.9 billion yen year on year for the overall segment due largely to an increase in revenues from the sale of assets against the backdrop of strong transaction market conditions and the full-year operation of TOKYO PORTCITY TAKESHIBA, or an increase of 11.2 billion yen year on year prior to transfer to loss on COVID-19 impact.

In the Property Management & Operation segment, the loss on COVID-19 impact on the Wellness business and Tokyu Hands business is limited compared to the previous fiscal year. As such, we are scheduling increases in profit for both businesses on a year-on-year basis. We forecast that operating profit in the segment as a whole will increase by 8.8 billion yen year on year, or by 12.7 billion yen prior to transfer to loss on COVID-19 impact.

|

|

|