|

|

|

|

|

|

|

|

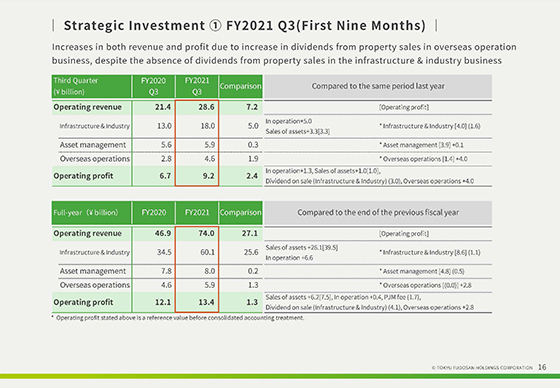

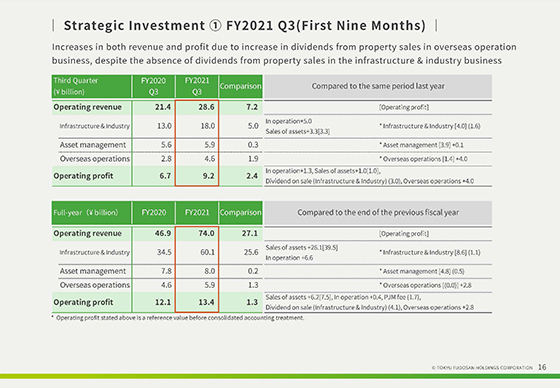

We will discuss the Strategic Investment business segment.

In the third quarter, operating revenue came to 28.6 billion yen and operating profit to 9.2 billion yen, representing increases in revenues and profit over the same quarter in the previous fiscal year.

In our Infrastructure & Industry business, while the sale of logistics facilities, the new operation of renewable energy facilities and other factors positively contributed, profit decreased due largely to a lesser bounce-back in sale dividends from previous fiscal year. In our overseas businesses, profit increased due largely to an increase in dividends from the sale of properties in the U.S.

For the full year, increases in revenues and profit are forecasted over the previous fiscal year, with operating revenue of 74.0 billion yen and operating profit of 13.4 billion yen. In the Infrastructure & Industry business, we are forecasting a decrease in profit due to a drop-off in fee income and a decrease in sale dividends from the previous fiscal year despite an increase in revenue from the sale of assets. However, our plan calls for an increase in profit for the segment as a whole due largely to an increase in sale dividends under our overseas businesses.

|

|

|